Day 82 of The X Proactive Test (Year 1): WRITING AND USING A PERSONAL MISSION STATEMENT: A personal mission statement is a declaration of your guiding principles, goals, and aspirations in life.

Mission Statement

Thursday, May 2, 2024

Wednesday, May 1, 2024

A PRINCIPLE CENTER

Day 81 of The X Proactive Test (Year 1): A PRINCIPLE CENTER: Principle-centered means based on fundamental values, beliefs, and ethical principles.

Tuesday, April 30, 2024

Accounting: The Language of Business - Vol. 2 (Intermediate: Part 142)

Short-Term Operating Assets: Cash and Receivable (Part G)

by

Charles Lamson

Uncollectible Account Write-Off

A company writes off an account receivable when it no longer expects to collect the amount due from a customer. When it decides to write off a specific amount, the company reduces or debits the allowance for uncollectible accounts and reduces or credits the accounts receivable. The write-off under the allowance method has no balance sheet affect related to the NRV of the accounts receivable. There is also no income statement effect from the write-off under the allowance method because the company previously reduced income by the estimated bad debt expense in the year of the sale. Companies maintain the general ledger account accounts receivable that reflects the amount of the gross accounts receivable reported on the balance sheet. In addition, companies include the specific customer accounts in an accounts receivable subsidiary ledger. When estimating the NRV of accounts receivable, the company uses the allowance for uncollectible accounts to offset the gross accounts receivable account on the balance sheet as opposed to any specific customer accounts. However, the company removes the individual customer account from the subsidiary ledger when it ultimately writes off the account. The gross accounts receivable and the allowance accounts are also reduced by the amount of the write-off. Example 9.7 provides an example of a write-off. GORDON, RAEDY, SANNELLA, 2019, INTERMEDIATE ACCOUNTING, 2ND ED., PP. 455-456* end |

Monday, April 29, 2024

ALTERNATIVE CENTERS

Day 79 of The X Proactive Test (Year 1): ALTERNATIVE CENTERS: Each of us has a center, though we usually don't recognize it as such. Neither do we recognize the all-encompassing effects of that center on every aspect of our lives.

Sunday, April 28, 2024

Training Vlog: Day 165 of Year 3 of Operation Great Reset - Build Back B...

Accounting: The Language of Business - Vol. 2 (Intermediate: Part 141)

When IBM released its first large computer in 1952, it was based on the vacuum tube, which was small enough that it made it possible for businesses to buy them and led to accountants being among the first to use them. By 1959, transistors were replacing the tubes and making computers even more accessible. As early as 1961, transistors were being supplanted by microchips, which eventually led to computers for everyone.

Today, technology has brought accounting software such as QuickBooks. These new advancements are much more intuitive, helping accountants do their job quicker, more accurately, and with more ease.

Short-Term Operating Assets: Cash and Receivables (Part F)

by

Charles Lamson

|

Uncollectible Accounts Estimates Managers form estimates of the amount expected to be uncollectible using the aging of accounts receivable method.

Aging of Accounts Receivable Under the aging of accounts receivable method, a company estimates the allowance for uncollectible accounts using the following steps:

Commonly, a company bases the percentage of uncollectible accounts in each age category on experience in collecting its accounts receivable and existing economic conditions. Percentages usually increase with the time the receivables are outstanding because collection becomes less likely for older balances. The aging of accounts receivable illustrated in Example 9.5 is considered a balance sheet approach because companies calculate the ending balance in the allowance account directly and focus on the proper measurement of accounts receivable at net realizable value (NRV), which describes the estimated amount that a company reasonably expects to collect from its customers and is measured as the gross accounts receivable less an estimated allowance for uncollectible accounts (a contra-asset account).. The resulting bad debt expense (Bad debt expense (BDE) is an accounting entry that estimates how much of a company's receivables it will not be able to collect. It is recorded as an expense on the company's income statement, and is deducted from revenue to calculate net income. BDE reduces receivables on the balance sheet.) and the matching of that expense to sales revenue are ignored. Using the aging of accounts receivable method, a company directly estimates the ending balance of the allowance account to determine the net realizable value (NRV) of accounts receivable. As a result, the amount for the bad debt expense, which is the change in the allowance account, is “ forced” to be set equal to the adjustment needed in the allowance account. The aging of accounts receivable method focuses on the proper balance sheet valuation of the NRV of accounts receivable. However, it may report a bad debt expense that does not match with current-period net sales. This issue is heightened when there is an existing debit balance in the allowance account [The balance in the allowance account could be a debit due to write-offs (which we discuss in the next part) in excess of amounts previously provided.] Under the aging of accounts receivable method, an existing debit balance would be added to the required allowance to arrive at the necessary journal entry as shown in Example 9.6. Companies must disclose the method they use to estimate the allowance for doubtful accounts. Exhibit 9.2 presents an example from Levi Strauss & Co. indicating that the company uses an aging of accounts receivable approach combined with other factors. EXHIBIT 9.2 Accounts Receivable Disclosure, Levi Strauss & Co. annual report, November 27th, 2016 Source: Levi Strauss and Co. Annual Report, 2016. *GORDON, RAEDY, SANNELLA, 2019, INTERMEDIATE ACCOUNTING, 2ND ED., PP. 452-455* end |

Saturday, April 27, 2024

AT THE CENTER

Day 77 of The X Proactive Test (Year 1): AT THE CENTER: In order to write a personal mission statement, we must begin at the very center of our Circle of Influence, that center comprised of our most basic paradigms, the lens through which we see the world.

Friday, April 26, 2024

Training Vlog: Day 163 of Year 3 of Operation Great Reset: Build Back Be...

Thursday, April 25, 2024

A PERSONAL MISSION STATEMENT

Day 75 of The X Proactive Test (Year 1): A PERSONAL MISSION STATEMENT: A personal mission statement is a concise declaration of your goals, core values, and aspirations. It can help you define your purpose and what you want to achieve in your life or career.

Wednesday, April 24, 2024

“Rescripting: Becoming Your Own First Creator”

Day 74 of The X Proactive Test (Year 1): “Rescripting: Becoming Your Own First Creator” is a concept from The 7 Habits of Highly Effective People by Stephen Covey. It involves using imagination and conscience to identify values, beliefs, and principles that guide one's life.

Tuesday, April 23, 2024

Training Vlog: Day 161 of Year 3 of Operation Great Reset - Build Back B...

LEADERSHIP AND MANAGEMENT--THE TWO CREATIONS

Day 73 of The X Proactive Test (Year 1): LEADERSHIP AND MANAGEMENT--THE TWO CREATIONS: Leadership is the first creation and management is the second. Leadership is about what you want to accomplish, while management is about how to accomplish it.

Monday, April 22, 2024

BY DESIGN OR DEFAULT

Day 72 of The X Proactive Test (Year 1): BY DESIGN OR DEFAULT: It's a principle that all things are created twice; the first creation being mental (i.e., a plan, intention, etc.). But, not all first creations are by conscious design.

Sunday, April 21, 2024

ALL THINGS ARE CREATED TWICE

Day 71 of The X Proactive Test (Year 1): “All things are created twice” is a quote by Stephen R. Covey from his book The 7 Habits of Highly Effective People. The quote means that everything has a mental or first creation, and a physical or second creation.

Saturday, April 20, 2024

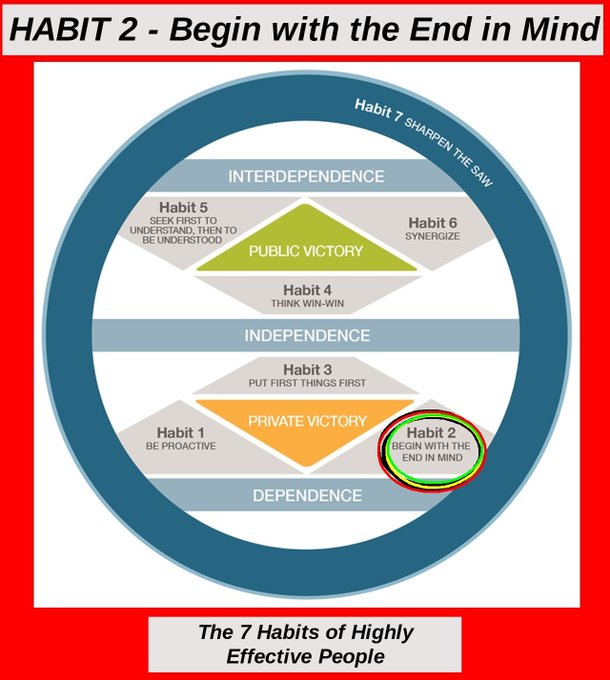

"Begin with the end in mind"

Day 70 of The X Proactive Test (Year 1): "Begin with the end in mind" is a habit that means to start with a clear understanding of your destination and then take steps in the right direction.

Accounting: The Language of Business - Vol. 2 (Intermediate: Part 140)

Short-Term Operating Assets: Cash and Receivables (Part E)

by

Charles Lamson

|

Accounting for Accounts Receivable: Subsequent Measurement

Managers understand that selling their products on credit increases total sales because customers prefer to buy on credit. However, there is the risk that the company will not collect the full amount of the receivables. The uncollectible portion of a company's receivables creates a measurement problem for accountants. Accounts receivable must be reported on the balance sheet at net realizable value. The term net realizable value (NRV) describes the estimated amount that a company reasonably expects to collect from its customers and is measured as the gross accounts receivable less an estimated allowance for uncollectible accounts (a contra-asset account). Firms report bad debt expense on the income statement to reflect the cost of uncollectible accounts. It is not possible to know which specific accounts will ultimately become uncollectible with certainty. Thus, at the end of each reporting period, management must estimate the NRV of accounts receivable and bad debt expense. The Allowance Message We now focus on the allowance method, which estimates the NRV of accounts receivable and the current period's bad debt expense in your period of the sale. There are two key considerations related to uncollectible accounts. (An alternative is to report bad debt expense only during the period when an account is determined to be uncollectible. This approach, known as the direct write-off method, is generally not allowed under GAAP.):

To illustrate, assume that a company sells a product on credit for $1,000, but it expects that the customer will ultimately pay only $900. As a result, the company will: 1. Report accounts receivable on the balance sheet at $900, computed as follows:

2. Record revenue of $1,000 and bad debt expense of $100 in the same. In this way, the allowance method measures the receivable at its NRV and reports the cost of selling on credit with the additional revenue generated from extending credit to customers in the same period. As noted earlier, companies estimating bad debt expense also create an allowance for uncollectible accounts (We also refer to the allowance for uncollectible accounts as the allowance for bad debts or the allowance for doubtful accounts.) The allowance account is a contra-asset that reduces accounts receivable so that the NRV of accounts receivable is reported on the balance sheet. Example 9.4 illustrates the allowance for uncollectible accounts. In the year in which a company determines that a specific account is uncollectible, it writes off the account receivable against the allowance without a further reduction of earnings. We will discuss write-offs in a later post. *GORDON, RAEDY, SANNELLA, 2019, INTERMEDIATE ACCOUNTING, 2ND ED., PP. 450-452* end |

Friday, April 19, 2024

Training Vlog: Day 158 of Year 3 of Operation Great Reset - Build Back B...

PLEASE FIND A PLACE TO READ THIS POST where you can be alone and uninterrupted.

Day 69 of The X Proactive Test (Year 1): PLEASE FIND A PLACE TO READ THIS POST where you can be alone and uninterrupted. Clear your mind of everything except what you will read and what I will invite you to do.

Thursday, April 18, 2024

PRINCIPLES OF PERSONAL LEADERSHIP

Day 68 of The X Proactive Test (Year 1): PRINCIPLES OF PERSONAL LEADERSHIP: "What lies behind us and what lies before us are tiny matters compared to what lies within us." -Oliver Wendell Holmes

WRITING AND USING A PERSONAL MISSION STATEMENT

Day 82 of The X Proactive Test (Year 1): WRITING AND USING A PERSONAL MISSION STATEMENT: A personal mission statement is a declaration o...

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(3)%20(1)%20(2)%20(1)%20(2)%20(2)%20(2)%20(3)%20(4)%20(1)%20(2).jpg)

-

Measurement Methods by Charles Lamson There are two major measurement methods: counting and judging. While counting is preferre...

-

Product Life Cycles by Charles Lamson Marketers theorize that just as humans pass through stages in life from infancy to death,...

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(3)%20(1)%20(2)%20(1)%20(2)%20(2)%20(2)%20(3)%20(1)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(3)%20(1)%20(2)%20(1)%20(2)%20(2)%20(3)%20(2)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(3)%20(1)%20(2)%20(1)%20(2)%20(2)%20(3)%20(3)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(3)%20(1)%20(2)%20(1)%20(2)%20(2)%20(2)%20(2)%20(2)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(2)%20(2)%20(2).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(2)%20(5)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(2)%20(8)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(2)%20(9)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(2)%20(10)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(2)%20(11)%20(1)%20(2)%20(1)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(3)%20(1)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(3)%20(1)%20(2)%20(1)%20(2)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(3)%20(1)%20(2)%20(1)%20(2)%20(2)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(3)%20(1)%20(2)%20(1)%20(2)%20(2)%20(2)%20(1)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(3)%20(1)%20(2)%20(1)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(2)%20(11)%20(1)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(2)%20(7)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(2)%20(3)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(4)%20(1)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(3)%20(1)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(2)%20(1)%20(2)%20(1).jpg)

%20(3)%20(1)%20(1)%20(3)%20(1)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(3)%20(2)%20(3)%20(4)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(3)%20(2)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(3)%20(2)%20(3)%20(1)%20(1).jpg)

%20(3)%20(1)%20(1)%20(5)%20(3)%20(2)%20(3)%20(3).jpg)