Mission Statement

Saturday, September 30, 2023

Friday, September 29, 2023

Thursday, September 28, 2023

Training Vlog: Day 331 of Year 2 of Operation Great Reset - Build Back B...

Wednesday, September 27, 2023

Training Vlog: Day 330 of Year 2 of Operation Great Reset - Build Back B...

Tuesday, September 26, 2023

Training Vlog: Day 329 of Year 2 of Operation Great Reset - Build Back B...

Monday, September 25, 2023

Accounting: The Language of Business - Vol. 2 (Intermediate: Part 104)

— Scott Belsky, co-founder of Behance

Accounting and the Time Value of Money (Part N)

by

Charles Lamson

| |

Present Value of an Annuity Due

|

Sunday, September 24, 2023

Saturday, September 23, 2023

Accounting: The Language of Business - Vol. 2 (Intermediate: Part 103)

— Jason Fried, CEO of Basecamp

Accounting and the Time Value of Money (Part M)

by

Charles Lamson

|

Factor Table Solution for Solving Present Value of Ordinary Annuity Problems. Table 7A.5 presents the factors for solving present value of ordinary annuity problems. Equation 7.14 solves present value of ordinary annuity problems using the factors in Table 7A.5.

Refer to the factor that is in the row for the number of compounding periods and the column for the interest rate per compounding period. For example, referring to Exhibit 7.12, the factor associated with four periods and a 2% interest rate is 3.80773. EXAMPLE 7.22 Present Value of an Ordinary Annuity: Table Approach Spreadsheet Solution to Solve the Present Value of Ordinary Annuity Problems. To solve the present value of ordinary annuity problems with a spreadsheet application such as Microsoft Excel, input the following variables into a spreadsheet cell: = PV(I/Y,N,PMT,FV,type) For the present value of an ordinary annuity, do not import a variable into the fifth position because if it is omitted, it is assumed to be zero. because the type defaults to zero, do not include the last variable when the payment occurs at the end of each period. Financial Calculator Solution for Value of Ordinary Annuity Problems. Finally, present value of an ordinary annuity problems can be solved using a financial calculator. To solve the problem in Example 7.23, enter the following keystrokes. The calculator shows the present value of the annuity is $(124,622.10). These keystrokes correspond to an inflow of $10,000 for 20 compounding periods at a 5% interest rate per compounding period. Note that the calculator defaults to “end mode” for an ordinary annuity because the cash flows occur at the end of each period. *GORDON, RAEDY, SANNELLA, 2019, INTERMEDIATE ACCOUNTING, 2ND ED., PP. 341-342* end |

Friday, September 22, 2023

The women who accompanied Jesus

| Luke 8:1-3 |

|---|

Training Vlog: Day 325 of Year 2 of Operation Great Reset - Build Back B...

Thursday, September 21, 2023

Training Vlog: Day 324 of Year 2 of Operation Great Reset - Build Back B...

Lam Mantra - Root Chakra Muladhara - Open up feelings of Security, Pros...

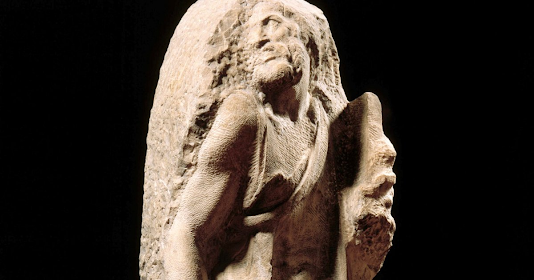

St Matthew, Apostle and Evangelist

|

See the article in the Catholic Encyclopaedia. |

Wednesday, September 20, 2023

Training Vlog: Day 323 of Year 2 of Operation Great Reset - Build Back B...

Tuesday, September 19, 2023

💚 Heart Chakra Healing with HANG Drum + Rain Music || Attract Love || Le...

Training Vlog: Day 322 of Year 2 of Operation Great Reset - Build Back B...

Monday, September 18, 2023

Sunday, September 17, 2023

Saturday, September 16, 2023

Accounting: The Language of Business - Vol. 2 (Intermediate: Part 102)

To say accounting for derivatives in America is a sewer is an insult to sewage.

Accounting and the Time Value of Money (Part L)

by

Charles Lamson

|

Present Value of Ordinary Annuity

In a present value of an ordinary annuity problem (cash flows occur at the end of the period), we know the payments, the interest rate, and the number of compounding periods, and we are asked to compute the present value. For example, assume that you have the opportunity to receive $100 at the end of each of the next three years. Given an interest rate of 8%, how much would you be willing to pay for this investment today? Exhibit 7.11 depicts this scenario graphically. We can solve this problem using a series of single sum problems as shown in the table below by computing the present value for each of the $100 payments. The present value for the first, second, and third payments, respectively, is $92.59, $85.73, and $79.38. We add these three present values together to get a total present value of $257.70. The difference between the sum of the nominal cash flows ($300) and the present value of the future cash flows ($257.70) represents the interest of $42.30 earned on the investment. By using the present value of $1 factors from Table 7A.2 (excerpted text from Part 94) we can also determine that you would be willing to pay no more than $257.70. Although present value of ordinary annuity problems can be solved using a series of single sum problems, it is more efficient to solve using a formula, table, spreadsheet, or financial calculator, all of which will be discussed in the next few parts. In the remainder of this post, we will discuss the formula solution. Formula Solution. Equation 7.13 is the formula for a present value of an ordinary annuity problem: EXAMPLE 7.21 Present Value of an Ordinary Annuity: Formula Approach *GORDON, RAEDY, SANNELLA, 2019, INTERMEDIATE ACCOUNTING, 2ND ED., PP. 339-340* end |

Friday, September 15, 2023

Training Vlog: Day 318 of Year 2 of Operation Great Reset - Build Back B...

'Woman, this is your son'

John 19:25-27

|

Near the cross of Jesus stood his mother and his mother’s sister, Mary the wife of Clopas, and Mary of Magdala. Seeing his mother and the disciple he loved standing near her, Jesus said to his mother, ‘Woman, this is your son.’ Then to the disciple he said, ‘This is your mother.’ And from that moment the disciple made a place for her in his home. |

Thursday, September 14, 2023

Training Vlog: Day 317 of Year 2 of Operation Great Reset - Build Back B...

Wednesday, September 13, 2023

Love

| 1 Corinthians 13:4-7 © | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Love is always patient and kind; it is never jealous; love is never boastful or conceited; it is never rude or selfish; it does not take offence, and is not resentful. Love takes no pleasure in other people’s sins but delights in the truth; it is always ready to excuse, to trust, to hope, and to endure whatever comes.

| ||||||||||

Tuesday, September 12, 2023

Monday, September 11, 2023

Training Vlog: Day 315 of Year 2 of Operation Great Reset - Build Back B...

Sunday, September 10, 2023

Accounting: The Language of Business - Vol. 2 (Intermediate: Part 101)

The stupid and dishonest accountants allowed the genie of totally inappropriate accounting to descend on derivatives books. And once this has happened - people get status, etc. - it's impossible to get it back into the bottle.

Accounting and the Time Value of Money (Part K)

by

Charles Lamson

Spreadsheet Solution for the Future Value of an Annuity Due. To solve for the future value of an annuity due with a spreadsheet application such as Microsoft Excel, input the following variables into a spreadsheets cell:

= FV(I/Y,N,PMT,PV,type) For the future value of an annuity due, we put a 1 in the fifth position because the payments occur at the beginning of each period period Financial Calculator Solution for Future Value of Annuity Due Problems. Finally, future value of annuity due problems can be solved using a financial calculator. To solve the problem in Example 7.20, enter the following keystrokes. The calculator shows the future value of the annuity due is $2,076,158.77. These keystrokes correspond to an outflow of $100,000 for 16 compounding periods at a 3% interest rate per compounding period. The fourth row of keystrokes adjusts the calculator settings to “ beginner mode” because this is an annuity due with the payments occurring at the beginning of the period as opposed to an ordinary annuity (the default mode) where the payments occur at the end of the period. *GORDON, RAEDY, SANNELLA, 2019, INTERMEDIATE ACCOUNTING, 2ND ED., PP. 338-339* end |

-

I'm double majoring in social studies - which is sociology, anthropology, economics, and philosophy - and African-American studies. Yara...

-

That's what hip-hop is: It's sociology and English put to a beat, you know. Talib Kweli Inequalities of Social Class (...

%20(1)%20(2)%20(1).jpg)

%20(2)%20(1).jpg)

%20(1)%20(1).jpg)

%20(1)%20(1).jpg)

.jpg)

.jpg)

.jpg)

%20(2)%20(1)%20(1).jpg)

%20(1).jpg)

%20(1).jpg)

%20(1)%20(1).jpg)

%20(1)%20(1).jpg)

%20(2).jpg)

.jpg)

.jpg)

%20(1).jpg)

%20(1).jpg)

%20(2).jpg)