Some Key Measures of Performance

by

Charles Lamson

Professional money managers and seasoned investors use a variety of financial ratios and measures when making common stock investment decisions. They look at such things as dividend yield, book value, return on equity, earnings per share, and price/earning multiples to get a feel for the investment merits of a particular stock. In short, they use these and other ratios to help them decide whether to invest in a particular stock. Fortunately, most of the widely followed ratios can be found in published reports, so you do not have to compute them yourself. Even so, if you are thinking about buying a stock, or already have a position in common stock, there are a few measures of performance you will want to keep track of. These would include book value (or book value per share), not profit margin, return on equity, earnings per share, price/earnings ratio, and beta.

Book Value

The amount of stockholders' equity in a firm is measured by book value. This accounting measure is determined by subtracting the firm's liabilities and preferred stocks from the value of its assets. Book value indicates the amount of stockholder funds used to finance the firm. For example, assume Rose Colored Glasses (RCG) had assets of $5 million, liabilities of $2 million, and preferred stock valued at $1 million. The book value of the firm's common stock would be $2 million ($5 million - $2 million - $1 million). If the book value is divided by the number of shares outstanding, the result is book value per share. If RCG had 100,000 of common stock outstanding, its book value per share would be $20 ($2,000,000/100,000 shares). Because of the positive impact it can have on the growth of the firm, you would like to see book value per share steadily increasing over time; also look for stocks whose market prices are comfortably above their book values.

Net Profit Margin

As a yardstick of profitability, net profit margin is one of the most widely followed measures of corporate performance. Basically, this ratio relates the net profits of the firm to its sales, providing an indication of how well the company is controlling its cost structure. The higher the net profit margin, the more money the company earns. Look for a relatively stable---or even better, an increasing---net profit margin.

Return on Equity

Another very important and widely followed measure, return on equity (or ROE, for short) reflects the overall profitability of the firm. It captures, in a single ratio, the amount of success the firm is having in managing its assets, operations, and capital structure. Return on equity is important because it has a direct and significant impact on the profits, growth, and dividends of the firm. The better the ROE, the better the financial condition and competitive position of the company. Look for a stable or increasing ROE and watch out for a falling ROE, as that could spell trouble.

Earnings per Share

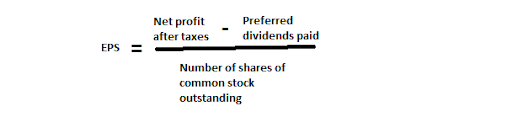

With stocks, the firm's annual earnings are usually measured and reported in terms of earnings per share (EPS). Basically, EPS translates total corporate profits into profits on a per-share basis and provides a convenient measure of the amount of earnings available to stockholders. Earnings per share is found by using the following simple formula:

For example, if RCG reported a net profit of $350,000, paid $100,000 in dividends to preferred stockholders, and had 100,000 shares of common outstanding, it would have an EPS of $2.50 [($350,000 - $100,000)/100,000]. Note that preferred dividends are subtracted from profits because they have to be paid before any monies can be made available to common. Earnings per share are closely followed by stockholders because it represents the amount the firm has earned on behalf of each outstanding share of common stock. Here, too, look for a steady rate of growth in EPS.

Price/Earnings Ratio

When the prevailing market price of a share of common stock is divided by the annual earnings per share, the result is the price/earnings (P/E) ratio, which is viewed as an indication of investor confidence and expectations. The higher the price/earnings multiple, the more confidence investors are presumed to have in a given security. In the case of RCG, whose shares are currently selling for $30, the price/earnings ratio is 12 ($30 per share/$2.50 per share). This means that RCG stock is selling for 12 times its earnings. P/E ratios are important to investors because they reveal how aggressively the stock is being priced in the market. Watch out for very high P/Es---that is, P/Es that are way out of line with the market---because that could indicate the stock is being overpriced (and thus might be headed for a big drop in price). P/E ratios are not static, but tend to move with the market: When the market is soft, a stock's P/E will be low, and when things heat up in the market, so will the stock's P/E.

Beta

A stock's beta is an indication of its price volatility. It shows how responsive a stock is to the market. In recent years, the use of betas to measure the market risk of common stock has become a widely accepted practice, and as a result, published betas are now available from most brokerage firms and investment services. The beta for a given stock is determined by a statistical technique that relates the stock's historical returns to the market. The market (as measured by something like the S&P index of 500 stocks) is used as a benchmark of performance, and it always has a beta of 1.0. From there, everything is relative: low-beta stocks---those with betas of less than 1.0---have low price volatility (they're relatively price-stable), while high-beta stocks---those with betas of more than 1.0---are considered to be highly volatile. In short, the higher a stock's beta, the more risky it is considered to be. Stock betas can be either positive or negative, though the vast majority are positive, meaning the stocks move in the same general direction of the market (that is, if the market is going up, so will the price of the stock).

Actually, beta is an index of price performance and is interpreted as a percentage response to the market. Thus, if RCG has a beta of say 0.8, it should rise (or fall) only 80 percent as fast as fast as the market---if the market goes up by 10 percent, RCG should go up only 8 percent (10 percent x .8). In contrast, if the stock had a beta of 1.8, it would go up or down 1.8 times as fast---the price of the stock would rise higher and fall lower than the market. Clearly, other things being equal, if you are looking for a relatively conservative investment, you should stick with low-beta stocks, on the other hand, if it is capital gains and price volatility you are after, then go with high-beta securities.

*SOURCE: PERSONAL FINANCIAL PLANNING, 10TH ED., 2005, LAWRENCE J. GITMAN, MICHAEL D. JOEHNK, PGS. 509-512*

end

|