“If you think nobody cares if you’re alive, try missing a couple of car payments.”

– Earl Wilson

Valuation and Rates of Return (part G)

by

Charles Lamson

|

Variable Growth and Dividends

In the discussion of common stock variation, we have considered procedures for firms that had no growth in dividends and for firms that had a constant growth. Most of the discussion and literature in finance assumes a constant growth dividend model. However, there is also a third case, and that is one of variable growth in dividends. The most common variable growth model is one in which the firm experiences supernormal (very rapid) growth for a number of years and then levels off to more normal, constant growth. The supernormal growth pattern is often experienced by firms in emerging Industries, such as the early days of electronics or microcomputers.

In evaluating a firm with an initial pattern of supernormal growth, we first take the present value of dividends during the exceptional growth period. We then determine the price of the stock at the end of the supernormal growth period by taking the present value of the normal, constant dividends that follow the supernormal growth period. We discount this price to the present and add it to the present value of the super normal dividends. This gives us the current price of the stock.

A numerical example of a supernormal growth rate evaluation model is presented below.

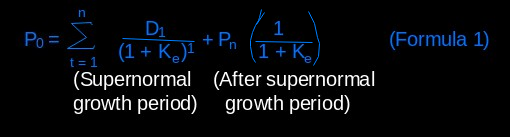

Valuation of a Supernormal Growth Firm

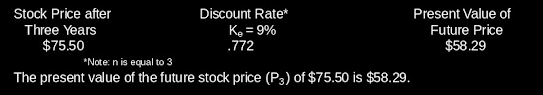

The equation for the valuation of a supernormal growth firm is: The formula is not difficult to use. The first term calls for determining the present value of the dividends during the supernormal growth period. The second term calls for computing the present value of the future stock price as determined at the end of the supernormal growth period. If we add the two, we arrive at the current stock price. We are adding together the two benefits the stockholder will receive: a future stream of dividends during the supernormal growth period And the future stock price. 1. Present Value of Supernormal Dividends--- We then discount these values back at 9% to find the present value of dividends during the supernormal growth period. The present value of the supernormal dividends is $6.07. We now turn to the future stock price. 2. Present Value of Future Stock Price--- We first find the future stock price at the end of the supernormal growth period. This is found by taking the present value of the dividends that will be growing at a normal, constant rate after the supernormal period. This will begin after the third and last period of supernormal growth. This is the value of the stock at the end of the third period. We just count this value back to the present. By adding together the answers in parts one and two of this post, we arrive at the total present value, or price, of the supernormal growth stock.The process is also Illustrated in Figure 1. Figure 1 Stock valuation under supernormal growth analysis Finally, in the discussion of common stock valuation models, you may ask about the valuation of companies that currently pay no dividends. Since virtually all our discussion has been based on values associated with dividends, how can this "no dividend" circumstance be handled? One approach is to assume that even for the firm that pays no current dividends, at some point in the future, stockholders will be rewarded with cash dividends. We then take the present value of their deferred dividends. A second approach to valuing a firm that pays no cash dividend is to take the present value of an earnings per share for a number of periods and add that to the present value of a future anticipated stock price. The discount rate applied to future earnings is generally higher than the discount rate applied to future dividends. *MAIN SOURCE: BLOCK & HIRT, 2005, FOUNDATIONS OF FINANCIAL MANAGEMENT, 11TH ED., PP. 286-288, 309-311* end |

No comments:

Post a Comment