Any difficult task seems easier if you break it down into manageable steps.

Unknown

Cash (Part E)

by

Charles Lamson

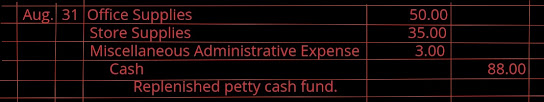

Petty Cash

As in your own day-to-day life, it is usually not practical for a business to write checks to pay small amounts such as postage. Yet these small payments may occur often enough to add up to a significant total amount. Thus it is desirable to control such payments. For this purpose, a special cash fund, called a petty cash fund, is used. A petty cash fund is established by first estimating the amount of cash needed for payments from the fund during a period, such as a week or a month. After necessary approvals, a check is written and cashed for this amount. The money obtained from cashing the check is then given to an employee, called the petty cash custodian, who is authorized to disburse monies from the fund. For control purposes, the company may place restrictions on the maximum amount and the types of payments that can be made from the fund. Each time monies are paid from petty cash, the custodian records the details of the payment on a petty cash receipt form. A typical petty cash receipt is illustrated in Exhibit 7. EXHIBIT 7 Petty Cash Receipt The petty cash fund is normally replenished at periodic intervals, or when it is depleted or reaches a minimum amount. When a petty cash fund is replenished, the accounts debited are determined by summarizing the petty cash receipts. A check is then written for this amount, payable to the petty cash custodian. To illustrate normal petty cash fund entries, assume that a petty cash fund of $100 is established on August 1. The entry to record this transaction is as follows: At the end of August, the petty cash receipts indicate expenditures for the following items: office supplies, $28; postage (office supplies), $22; store supplies, $35; and daily newspapers (miscellaneous administrative expense), $3. The entry to replenish the petty cash fund on August 31 is as follows: Replenishing the petty cash fund restores it to its original amount of $100. You should note that there is no entry in petty cash when the fund is replenished. Petty cash is debited only when the fund is initially set up or when the amount of the fund is increased at a later time. Petty cash is credited if it is being decreased. Presentation of Cash on the Balance Sheet Cash is the most liquid asset, and therefore it is listed as the first asset in the current assets section of the balance sheet. Most companies present only a single cash amount on the balance sheet by combining all their bank and cash fund accounts. A company may have cash in excess of its operating needs. In such cases, the company normally invests in highly liquid investments in order to earn interest. These Investments are called cash equivalents. Examples of cash equivalents include U.S. Treasury Bills, notes issued by major corporations (referred to as commercial paper), and money market funds. Companies that have invested excess cash in cash equivalents usually report Cash and cash equivalents as one amount on the balance sheet. Banks may require depositors to maintain minimum cash balances in their bank accounts. Such a balance is called a compensating balance. This requirement is often imposed by the bank as a part of a loan agreement or line of credit. A line of credit is a preapproved amount the bank is willing to lend to a customer upon request. Compensating balance requirements should be disclosed in notes to the financial statements. Financial Analysis and Interpretation In an earlier post, we discussed the use of working capital and the current ratio in evaluating a company's ability to pay its current liabilities (short-term solvency). Both of these measures assume that the noncash current assets will be converted to cash in time to pay the current liabilities. For most companies, these measures are useful for assessing short-term solvency. However, a company that is in financial distress may have difficulty converting its receivables, inventory, and prepaid assets to cash on a timely basis. In these cases, the ratio of cash to current liabilities may be useful in assessing the ability of creditors to collect what they are owed. Because this ratio is most relevant for companies in financial distress, it is called the doomsday ratio. Its name comes from the worst-case assumption that the business ceases to exist and only the cash on hand is available to meet creditor obligations. In computing the ratio of cash to current liabilities, cash and cash equivalents are used in the numerator, as shown below. Doomsday ratio = Cash and cash equivalents / Current liabilities To illustrate, assume the following data for Laetner Co. and Oakley Co. for the current year: The doomsday ratio for each company is computed as follows. In this case, Oakley Co. Is more risky to creditors than is Leattner. Because most businesses maintain cash and cash equivalents at amounts substantially less than their current liabilities, the doomsday ratio is almost always less than one. Differences among companies will occur because of differences in management philosophy and operating styles. Nevertheless, a comparison over time that indicates a decreasing ratio generally indicates more risk for creditors. *WARREN, REEVE, & FESS, 2005, ACCOUNTING, 21ST ED., PP. 295-298* end |

No comments:

Post a Comment