The Automobile Lease Versus Purchase Analysis

by

Charles Lamson

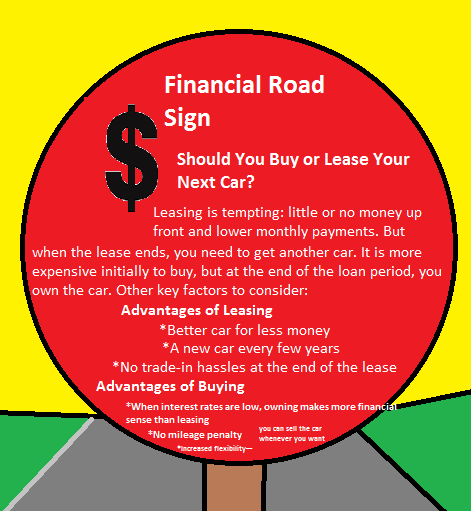

To decide whether it is less costly to lease rather than purchase a car, you need to perform a lease versus purchase analysis to compare the total cost of leasing to the total cost of purchasing a car over equal periods. In this analysis, the purchase is assumed to be financed with an installment loan with the same term as the lease.

For example, assume that Mary Dixon is considering either leasing or purchasing a new Ford Focus sedan costing $15,000. The three-year, closed-end lease she is considering requires a $1,500 down payment (capital cost reduction), a $300 security deposit and monthly payments of $300 including sales tax. If she purchases the car she will make a $2,500 down payment and finance the balance with a three-year, 8 percent loan requiring monthly payments of $392. In addition she will have to use 5 percent sales tax ($750) on the purchase and she expects the car to have a residual value of $8,000 at the end of 3 years. Many can earn 4 percent interest on her savings with short-term CDs. After filling in Worksheet 1, Mary concludes that purchasing is better because its total cost of $9,662 is $2,854 less than the $12,516 total cost of leasing---even though the monthly lease payment is $92 lower. Clearly, all else being equal, the least costly alternative is preferred.

|

smart.sites

If you are still unsure whether to lease or buy, try letting the numbers help you make the right decision. Go to www.edmunds.com “Decision Calculator” and see how much leasing or buying will cost for the same car.

|

end

No comments:

Post a Comment