MUTUAL FUNDS: SOME BASICS

by

Charles Lamson

|

The Mutual Fund Concept

The first mutual fund in this country was started in Boston in 1924; by 1940, there were 68 mutual funds in operation, and by 1980, there were 564. There are now well over 15,000 funds available. To put this number in perspective, there are more mutual funds in existence today than there are stocks listed on the New York and American exchanges combined! The fund industry has grown so much, in fact, that it is now the largest financial intermediary in this country---ahead of even banks.

In mid-2017, an estimated 56.2 million households, or 44.5 percent of all US households, owned mutual funds. The current estimate of the number of individual investors owning mutual funds is 100.0 million (https://www.ici.org/faqs/faq/mfs/faqs_mf_shareholders). Clearly, mutual funds appeal to a lot of investors---investors who come from all walks of life and all income levels. And they all share one common view: They have decided for one reason or another, to turn the problem of security selection and portfolio management over to professional money managers. Questions of which stock or bond to select, when to buy, and when to sell have plagued investors for about as long as there have been organized securities markets. Such concerns lie at the very heart of the mutual fund concept and, in large part, are behind the growth in funds. The fact is, a lot of people simply lack the time, the know-how, or the commitment to manage their own securities. As a result, they turn to others. And more often than not, that means mutual funds.

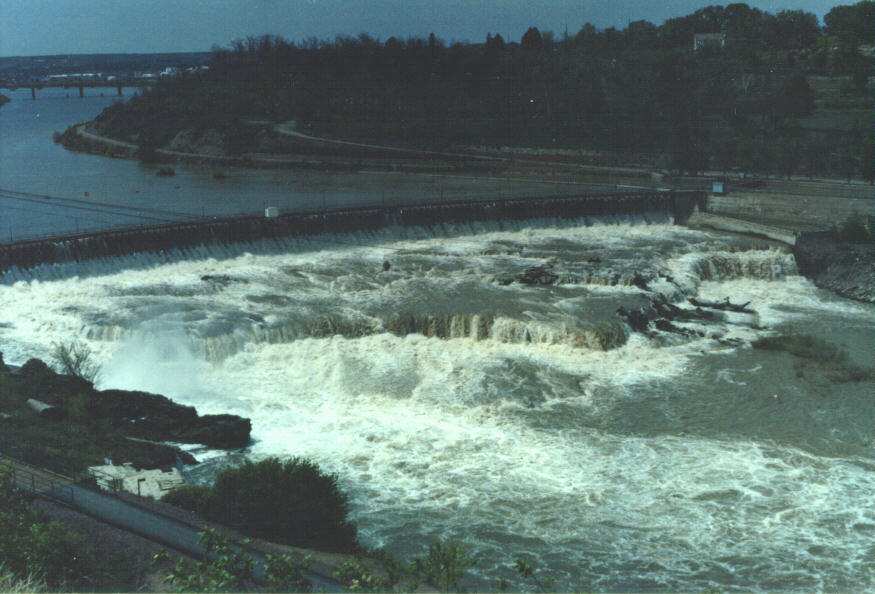

US Household Ownership of Mutual Funds

Millions, selected years

*Sources: Investment Company Institute and US Census Bureau*

smart.sites

Want to know more about the fund industry, from the funds themselves to fund investors and legislation affecting funds? The Investment Company Institute Web site (www.ici.org) has all the answers.

|

Pooled Diversification

The mutual fund concept is based on the simple idea of turning the problems of security selection and portfolio management over to professional money managers. In essence, a mutual fund combines the investment capital of many people with similar investment goals, and invests the funds in a wide variety of securities. Investors receive shares of stock in the mutual fund and, through the fund, are able to enjoy much wider investment diversification than they could otherwise achieve.

No matter what the size of the fund, as the securities held by it move up and down in price, the market value of the mutual fund shares moves accordingly. And when dividend and interest payment are received by the fund, they too are passed on to the mutual fund shareholders and distributed on the basis of prorated ownership. For example, if you own 1,000 shares of stock in mutual fund and that represents, say, 1 percent of all shares outstanding, you would receive 1 percent of the dividends paid by the fund. When a security held by the fund is sold for a profit, the capital gain is also passed on to fund shareholders. The whole mutual fund idea, in fact, rests on the oncept of pooled diversification, and works very much like insurance, whereby individuals pool their resources for the collective benefit of all the contributors.

*SOURCE: PERSONAL FINANCIAL PLANNING, 10TH ED., 2005, LAWRENCE J. GITMAN, MICHAEL D. JOEHNK, PGS. 550-552*

end

No comments:

Post a Comment