Negotiable Instruments

by

Charles Lamson

Negotiable instruments or commercial paper are writings drawn in a special form that can be transferred from person to person as a substitute for money or as an instrument of credit. Such an instrument must meet certain definite requirements in regard to its form and the manner in which it is transferred. Two types of negotiable instruments include checks and notes. Since a negotiable instrument is not money, the law does not require a person to accept one in payment of a debt.

History and Development

The need for instruments of credit that would permit the settlement of claims between distant cities without the transfer of money has existed as long as trade has existed. References to bills of exchange or instruments of credit appeared as early as 50 BC. Their widespread usage, however, began about AD 1200 as international trade began to flourish in the wake of the Crusades. At first these credit instruments were used only in international trade, but they gradually became common in domestic trade.

In England, prior to AD 1400, special courts set up on the spot by the merchants settled all disputes between merchants. The rules applied by these courts became known as the law merchant. Later the common law courts took over the adjudication of all disputes, including those between merchants. However, these courts retained most of the customs developed by the merchants and incorporated the law merchant into the common law. Most, but by no means all, of the law merchant dealt with bills of exchange or credit instruments.

In the United States, each state modified in its own way the common law dealing with credit instruments so that eventually the various states had different laws regarding credit instruments. The American Bar Association and the American Banks Association appointed a commission to draw up a Uniform Negotiable Instruments Law. In 1896, the commission proposed the uniform act. This act was adopted in all the states, but article 3 of the Uniform Commercial Code UCC then displaced it.

In 1990, a commission that writes uniform laws issued a revised Article 3. Because almost all of the states have adopted the provision, this text explains the law according to the changes made by the revision. The revision uses the term negotiable instruments while the original Article 3 uses the term commercial paper.

Negotiation

Negotiation is the act of transferring ownership of a negotiable instrument to another party. The owner may negotiate a negotiable instrument owned by and payable to such owner. The owner negotiates it by signing the back of it and delivering it to another party. The signature of the owner made on the back of a negotiable instrument before delivery is called an indorsement (Indorsement is the spelling used in the UCC, although endorsement is commonly used in business).

When a negotiable instrument is transferred to one or more parties, these parties may acquire rights superior to those of the original owner. Parties who acquire rights superior to those of the original owner are known as holders in due course. It is mainly this feature of the transfer of superior rights that gives negotiable instruments a special classification all their own.

Order Paper and Bearer Paper

If commercial paper is made payable to the order of a named person, it is called order paper. If commercial paper is made payable to whoever has possession of it, the bearer, it is called bearer paper. Bearer paper may be made payable to bearer, cash, or any other indication that does not report to designate a specific person. Order paper must use the word order, as in the phrase, "pay to the order of John Doe," or some other word to indicate it may be paid to a transferee. Order paper is negotiated only by endorsement of the person to whom it is then payable and by delivery of the paper to another person. In the case of bearer paper, merely handing the paper to another person may make the transfer.

Payment is made on a different basis with order paper than with bearer paper. Order paper may be paid only to the person to whom it is made payable on its face are the person to whom it has been properly endorsed. However, bearer paper may be paid to any person in possession of the paper.

Classification of Commercial Paper

The basic negotiable instruments are:

Drafts

A draft is also called a bill of exchange. It is a written order signed by one person and requiring the person to whom it is addressed to pay on demand or at a particular time a fixed amount of money to order or to bearer. checks and trade acceptances are special types of drafts. When you make out a check on your bank account you are actually writing out a type of draft.

Promissory Notes

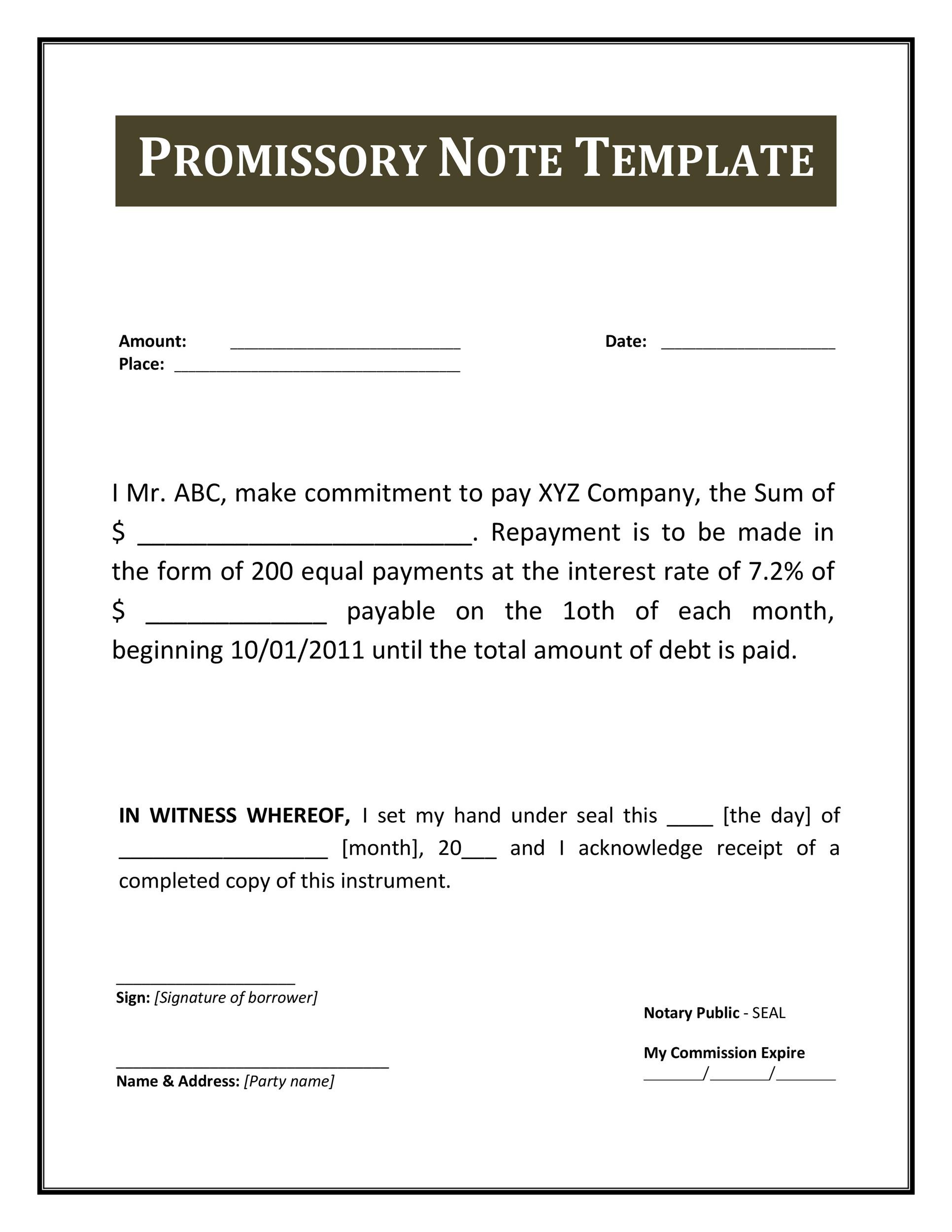

A promissory note is an unconditional promise in writing made by one person to another, signed by the promisor, engaging to pay on demand of the holder, or at a definite time, a fixed amount of money to order or to bearer (see Illustration 1). If the note is a demand instrument, the holder may demand payment or sue for payment at any time and for any reason.

ILLUSTRATION 1 Promissory Note

Parties to Negotiable Instruments

Each party to a negotiable instrument is designated by a certain term, depending upon the type of instrument. Some of these terms apply to all types of negotiable instruments, whereas others are required to one type only. The same individual may be designated by one term at one stage and by another at a later stage through which the instrument passes before it is collected. These terms include payee, drawer, drawee, acceptor, maker, bearer, holder, indorser, and indorsee.

Payee

The person or persons to whom any negotiable instrument is made payable is called the payee.

Drawer

The person who executes or signs any draft is called the drawer.

Acceptor

A drawee who accepts a draft, thus indicating a willingness to assume responsibility for its payment, is called the acceptor. A person accepts drafts not immediately payable by writing upon the face of the instruments these or similar words: Accepted, Jane Daws. This indicates that Jane Daws will perform the contract according to its terms.

Maker

The person who executes a promissory note is called the maker. The maker contracts to pay the amount due on the note. This obligation resembles that of the acceptor of a draft.

Bearer

Any negotiable instrument may be made payable to whoever possesses it. The payee of such an instrument is the bearer. If the instrument is made payable to the order of Myself, Cash, or another similar name, it is payable to the bearer.

Holder

Any person who possesses an instrument is the holder if it has been delivered to the person and it is either bearer paper or it is payable to that person as the payee or by indorsement. The payer is the original holder of an instrument.

Holder in Due Course

A holder who takes a negotiable instrument in good faith and for value is a holder in due course.

Indorser

When the payee of a draft oe a note wishes to transfer the instrument to another party, it must be endorsed. The payee is then called the indorser. The payee makes the endorsement by signing on the back of the instrument.

Indorsee

A person who becomes the holder of a negotiable instrument by an indorsement that names him or her as the person to whom the instrument is negotiated is called the indorsee.

Negotiation and Assignment

The right to receive payment of instruments may be transferred by either negotiation or assignment. Nonnegotiable paper cannot be transferred by negotiation. The rights to it are transferred by assignment. Negotiable instruments may be transferred by negotiation or assignment. The rights given the original parties are alike in the cases of negotiation and assignment. In the case of a promissory note, for example, the original parties are the maker (the one who promises to pay) and the payee (the one to whom the money is to be paid). Between the original parties, both a nonnegotiable and a negotiable instrument are equally enforceable. Also, the same defenses against fulfilling the terms of the instrument may be set up. For example, if one party to the instrument is a minor, the incapacity to contract may be set up as a defense against carrying out the agreement.

However, the rights given to subsequent parties differ depending on whether an instrument is transferred by negotiation or assignment. When an instrument is transferred by assignment, the assignee receives only the rights of the assignor and no more. If one of the original parties to the instrument has a defense that is valid against the assignor, it is also valid against the assignee.

When an instrument is transferred by a negotiation, however, the party who receives the instrument in good faith and for value may obtain rights that are superior to the rights of the original holder. Defenses that may be valid against the original holder may not be valid against the holder who has received an instrument by negotiation.

Credit and Collection

Negotiable instruments are called instruments of credit and instruments of collection. If A sells B merchandise on 60 days credit, the buyer may at the time of the sale execute a negotiable note or draft do in 60 days in payment of the merchandise. This note or draft then is an instrument of credit.

If the seller in the transaction above will not extend the original credit to 60 days, a draft may be drawn on the buyer, who would be the drawer. In this case, the drawer may make a bank the payee, the bank being a mere agent of the drawer, or one of the seller's creditors may be made the payee so that an account receivable will be collected and an account payable will be paid all in one transaction. When the account receivable comes due, the buyer will mail a check to the seller. In this example, the draft is an instrument of collection.

Electronic Fund Transfers

More and more transfers of funds occur today in which a paper instrument is not actually transferred and the parties do not have face-to-face, personal contact. An electronic funds transfer (EFT) is any transfer of funds initiated by means of an electronic terminal, telephone instrument, or computer or magnetic tape that instructs or authorizes a financial institution to debit or credit an account. EFT does not include a transfer of funds begun by a check, draft, or similar paper instrument.

EFTs are popular because they are faster and less expensive than the transfer of paper instruments. EFTs can reduce the risk resulting from lost instruments. If a check, for example, does not have to make the entire trip from the payee to the drawee bank to the drawer customer, costs and delays can be reduced.

A federal law, the Electronic Fund Transfer Act, regulates EFTs and defines them as carried out primarily by electronic means. A transfer initiated by a telephone call between a bank employee and a customer is not an EFT unless it is in accordance with a prearranged plan.

The law requires disclosure of the terms and conditions of the EFTs involving a customer's account at the time the customer contracts for an EFT service. This notification must include

Under this law, a customer's liability for an unauthorized EFT can be limited to $50; however, the customer must give the bank very prompt notice circumstances that lead to the belief that an unauthorized EFT has been or may be made. Also, a bank does not need to reimburse a customer who fails to notify a bank of an unauthorized EFT within 60 days of receiving a bank statement on which the unauthorized EFT appears.

Several widely used types of EFTs include check truncation, preauthorized debts and credits, automated teller machines, and point-of-sale systems.

Check Truncation

A system of shortening the trip a check makes from the payee to the drawee bank and then to the drawer is called check truncation. It used to be that all banks returned canceled checks to customers with a monthly bank statement. However, most banks no longer return the actual canceled checks to their customers with their monthly statements. Instead, the statements to customers list the check numbers. The dollar amount on the checks is shown, and the transactions are printed in numerical order. The customer can easily reconcile the account without having the canceled checks. However, banks must be able to supply legible copies of the checks at the customer's request for 7 years. This is a type of check truncation.

Preauthorized Debit and Credits

Checking account customers may authorize that recurring bills, such as home mortgage payments, insurance premiums, or utility bills, be automatically deducted from their checking account each month. This is called a preauthorized debit. It allows a person to avoid the inconvenience and cost of writing out and mailing checks with these bills.

A preauthorized credit allows the amount of regular payments to be automatically deposited in the payers account. This type of EFT is frequently used for depositing salaries and government benefits, such as Social Security payments. It benefits the payor, who does not have to issue and mail the checks. The payee does not have to bother depositing a check and normally has access to the funds sooner.

Automated Teller Machines

An automated teller machine (ATM) is an EFT terminal capable of performing routine banking services. Many thousands of such machines exist at locations designed to be accessible to customers. The capabilities of the machines vary; however, some ATMs do such things as dispense cash and account information and allow customers to make deposits, transfer funds between accounts, and pay bills. ATMs are conveniently found it many locations, even in foreign countries, and are open when banks are not.

Point-of-Sale Systems

Electronic fund transfers that begin at retailers when consumers want to pay for goods or services with debit cards are called point-of-sale systems (POS). These transactions occur when the person operating the POS terminal enters information regarding the payment into a computer system. The entry debits the consumer's bank account and credits the retailer's account by the amount of the transaction.

INTERNET RESOURCES FOR BUSINESS LAW  *SOURCE: LAW FOR BUSINESS, 15TH ED., 2005, JANET E. ASHCROFT, PGS. 238-248*

end

|

No comments:

Post a Comment