Promissory Notes and Drafts (part C)

by

Charles Lamson

Checks

A check is a type of draft. To be a check, the draft must be drawn on a bank and payable on demand. It is a type of sight draft with the drawee, a bank, and the drawer, a depositor---a person who has funds deposited with a bank. Just like other drafts, the check is an order by the drawer, upon the drawee, to pay a sum of money to the order of another person, the payee.

|

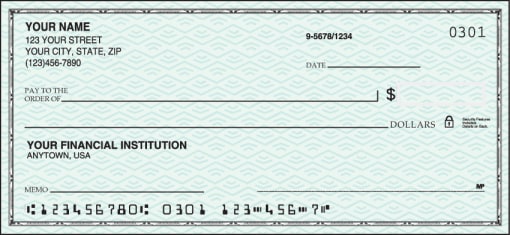

The numbers at the bottom of a check (see Illustration 1) are printed in magnetic ink. The numbers identify the specific account and the bank that holds the account. Since the numbers are printed in magnetic ink, the check may be sorted by electronic data processing equipment. The Federal Reserve System requires that all checks passing through its clearinghouses be imprinted with search identifying magnetic ink. In most cases, however, the drawee bank will accept checks that do not carry the magnetic ink coating. In fact, the material upon which a check is written does not affect the validity of a check.

ILLUSTRATION 1 Check

Special Kinds of Checks

Five special types of checks include:

Certified Checks. A certified check is an ordinary check accepted by an official of the drawee bank. The official accepts it by writing across the face of the check the word certified, or some similar word, and signing it. Either the drawer or the holder may have a check certified. The certification of the check by the bank has the same effect as an acceptance. It makes the bank liable for the payment of the check and binds it by the warranties made by an acceptor. A certification obtained by a holder releases the drawer from liability.

The drawer of a draft accepted by a bank is relieved of liability on the instrument. It does not matter when or by whom acceptance was obtained.

Cashier's Checks. A check that a bank draws on its own funds and that the cashier or some other responsible official of the bank signs is called a cashier's check. It is accepted for payment when issued and delivered. A bank in paying its own obligations may use such a check, or it may be used by anyone else who wishes to remit money in some form other than cash or personal check.

Bank Drafts. A bank draft or teller's check is a check drawn by one bank on another bank. Banks customarily keep a portion of their funds on deposit with other banks. A bank, then, may draw a check on these funds as freely as any corporation may draw checks. People purchase teller's checks because they rely on the banks credit, not an individual's. Also, a purchaser of a teller's check has no right to insist that the issuing bank stop payment on a teller's check that is not payable to the purchaser. Thus, teller's checks are more readily accepted by payees than are personal checks.

Voucher Checks. A voucher check is a check with a voucher attached. The voucher lists the items of an invoice for which the check is the means of payment. In business the drawer of the check customarily writes on the check such words as "In full of account, For invoice No. 1622," or similar notations. These notations make the checks excellent receipts when returned to the drawer. Check on which additional space is provided for the drawer to make a notation for which the check is issued is sometimes referred to as a voucher check. A payee who endorses a check on which a notation has been made agrees to the terms of the check, which include the terms written in the notation by the drawer.

Traveler's Checks. A traveler's check is an instrument much like a cashier's check of the issuer except that it requires signature and countersignature by its purchaser. Traveler's checks, sold by banks and express companies, are payable on demand. The purchaser of travelers checks signs each check once at the time of purchase and then countersigns it and fills in the name of the payee when the check is to be used.

Postdated Checks

A check drawn prior to the time it is dated is a postdated check. If it is drawn on June 21st but dated July 1st it is in effect, a 10-day draft. There is nothing unlawful about a postdated check as long as it was not postdated for an illegal or fraudulent purpose. A bank on which the check is drawn may pay it before it's date without liability unless the customer/drawer has properly notified the bank of the post dated check.

Bad Checks

If a check is drawn with intent to defraud the payee, the drawer is civilly liable, as well as subject to criminal prosecution in Most states under so-called bad check laws. A bad check is a check that the holder sends to the drawee bank and the bank refuses to pay, normally for insufficient funds. Usually these statutes state that if the check is not made good within a specific period, such as 10 days, a presumption arises that the drawer originally issued the check with the intent to defraud.

Duties of the Bank

The bank owes several duties to its customer, the depositor-drawer. It must maintain secrecy regarding information acquired by it in connection with the depositor-bank relationship.

The bank also has the duty of comparing the signature on the depositor's check with the signature of the depositor in the bank's files to make certain the signatures on the checks are valid. If the bank pays a check that does not have the drawer's signature, it is liable to the drawer for the loss.

Refusal of Bank to Pay. The bank is under a general contractural duty to its depositors to pay on demand all of their checks to the extent of the funds deposited to their credit. When the bank breaches this contract, it is liable to the drawer for damages. The bank must also pay checks that exceed the amount on deposit if there is an agreement that the bank will pay overdrafts. In the case of a draft other than a check, there is ordinarily no duty on the drawee to accept the draft or to make payment if it has not been accepted. Therefore, the drawee is not liable to the drawer when an unaccepted draft is not paid.

Even if the normal printed form supplied by the bank is not used, the bank must pay a proper order by a depositor. The bank must honor any written document that contains the substance of a normal printed check.

A divorced man making his last alimony payment wrote a check on a T-shirt to send a message to his ex-wife that she was "taking the shirt off his back." She did not care for the technique, but the T-shirt check was valid.

Liability of the drawee bank for improperly refusing to pay a check only runs in favor of the drawer. Even if the holder of the check or the payee may be harmed when the bank refuses to pay the check, a holder or payee has no right to sue the bank. However, the holder has the right of action against the person from whom the check was received. This right of action is based on the original application, which was not discharged because the check was not paid.

A check that is presented more than six months after its date is commonly called a stale check. A bank that acts in good faith may pay it. However, unless the check is certified, the bank is not required to pay it.

Stopping Payment. Drawers have the power of stopping payment of checks. After a check is issued, a drawer can notify the drawee bank not to pay it when presented for payment. This is a useful procedure when a check is lost or mislaid. A duplicate check can be written, and to make sure that the payee does not receive payment twice or that an improper person does not receive payment on the first check, payment on the first check can be stopped. Likewise, if payment is made by check and the payee defaults on the contract, payment on the check can be stopped, assuming that the payee has not cashed it.

A stop-payment order may be written or oral. The bank is bound by an oral stop payment order only for 14 calendar days unless confirmed in writing within that time. A written order is effective for no more than 6 months unless renewed in writing.

Unless a valid limitation exists on its liability, the bank is liable for the loss the depositor sustains when the bank makes payment on a check after receiving proper notice to stop payment. However, the depositor has the burden of proving the loss sustained.

A depositor who stops payment without a valid reason may be liable to the payee. Also, the depositor is liable to stopping payment with respect to any holder in due course or other party having the rights of the holder in due course unless payment is stopped for a reason that may be asserted against such a holder as a defense. The fact that the bank refuses to make payment because of the drawer's instruction does not make the case any different from any other instance in which the drawee refuses to pay, and the legal consequences of imposing liability upon the drawer are the same.

When the depositor makes use of a means of communication such as the telegraph to give a stop payment notice, the bank is not liable if the notice is delayed in reaching the bank and the bank makes payment before receiving the notice. The depositor can, however, sue the telegraph company if negligence on its part can be shown.

A payee who wants to avoid the potential of payment being stopped may require a certified check of the buyer or a cashier's check from the buyer's bank because neither the buyer nor the buyer's bank can stop payment to the payee on such checks.

Payment After Depositors Death. Usually a check is ineffective after the drawer dies. However, until the bank knows of the death and has had a reasonable opportunity to act, the bank's agency is not revoked. A bank may even continue to pay or certify a depositor's checks for 10 days unless a person claiming an interest in the estate orders it to stop.

Bank Customers Responsibility

While the bank has several duties to its customers, customers also have some important responsibilities. They must examine monthly bank statements and notify the bank with reasonable promptness of any forged signatures. If a customer fails to do this and the bank suffers loss as a result, the customer will be liable for the loss. Reasonable promptness is not defined, but the UCC provides that a customer who does not report an unauthorized signature or alteration within one year may not assert them against the bank. If there is a series of forgeries by the same person, the customer must discover and report the first forged check to the bank within the time prescribed by agreement between the customer and bank. If no such time is prescribed, it must be within 30 days of receiving the bank statement.

INTERNET RESOURCES FOR BUSINESS LAW *SOURCE: LAW FOR BUSINESS, 15TH ED., 2005, JANET E. ASHCROFT, J.D., PGS. 263-271*

end

|

No comments:

Post a Comment