"Justice in the life and conduct of the State is possible only as first it resides in the hearts and souls of the citizens."

Management and Dissolution of a Corporation (part A)

by

Charles Lamson

An artificial being, existing only in contemplation of law, a corporation can perform business transactions only through actual persons, acting as agents. The directors as a group act as both fiduciaries and agents. To the corporation, they are trustees and have responsibility for breaches of trust. To third parties, directors as a group constitute agents of the corporation.

|

The board of directors selects the chief agents of the corporation, such as the president, the vice president, the treasurer, and other officers, who perform the managerial functions. The board of directors is primarily a policy-making body. The chief executives in turn appoint subagents for all the administrative functions of the corporation. These subagents constitute agents of the corporation, however, not of the appointing executives.

The directors and officers manage the corporation. Since the stockholders elect the board of directors, they indirectly control it. However, neither the individual directors nor a stockholder, merely by reason of membership in the corporation, can act as an agent or exercise any managerial function.

Even a stockholder who owns 49 percent of the common stock of a corporation has no more right to work or take a direct part in running the corporation than another stockholder or even a stranger would have. In contrast, a person who owns even 1 percent of a partnership has just as much right to work for the partnership and to participate in its management as any other partner.

Stockholders' Meetings

In order to make the will of the majority binding, the stockholders must act at a duly convened and properly conducted stockholders' meeting.

A corporation usually holds the regular meeting such as its annual meeting at the place and time specified in the articles of incorporation or in the bylaws; notice of the meeting is ordinarily not required (see Illustration 1). The directors of the corporation or, in some instances, a particular officer or a specified number of stockholders, may call a special meeting. The corporation must give notice specifying the subject to be discussed for a special meeting.

ILLUSTRATION 1 Notice of a Shareholders' Meeting

Meetings of the stockholders theoretically act as a check upon the board of directors. Corporations must have one annually. If the directors do not carry out the will of the stockholders, they can elect a new board that will carry out the stockholders' wishes. In the absence of fraud or bad faith on the part of the directors, this procedure constitutes the only legal means by which the investors can exercise any control over their investment.

Quorum

A stockholders' meeting, in order to be valid, requires the presence of a quorum, or a minimum number of shares that must be represented in order that business may be lawfully transacted. At common law a quorum consisted of the stockholders actually assembled at a properly convened meeting. Majority of the votes cast by those present express the will of the stockholders. Statutes, bylaws, or other articles of incorporation now ordinarily require that a majority of the outstanding stock be represented at the stockholders meeting in order to constitute a quorum. This representation may be either in person or by proxy.

Voting

The right of a stockholder to vote is the most important right, because only in this way can the stockholder exercise any control over investment in the corporation. Only stockholders shown by the stockholders record book have a right to vote. A person who purchases stock from an individual does not have the right to vote until the corporation makes the transfer on its books. Subscribers who have not fully paid for their stock, as a rule, may not vote. State corporation laws control the right to vote. Voting and nonvoting common stock may be issued if the law permits.

Two major classes of elections are held during stockholders' meetings in which the stockholders vote. They include the annual election of directors and the elections to approve or disapprove some corporate acts that only the stockholders can authorize. Examples of some of some of these acts are consolidating with another corporation, dissolving, increasing the capital stock, and changing the number of directors.

Giving Minority Stockholders a Voice. Each stockholder normally has one vote for each share of common stock owned. In the election of a board of directors, the candidates receiving a majority of the votes of stock actually voting win. In corporations with 500,000 stockholders, control of 10 percent of the stock often suffices to control the election. In all cases the owners of 51 percent of the stock can elect all the directors. This leaves the minority stockholders without any representation on the board of directors. To alleviate the situation, two legal devices exist that may give the minority stockholders a voice, but not a controlling voice, on the board of directors. These devices are:

Some state statutes provide that in the election of directors, a stockholder may cast as many votes in the aggregate equal to the number of shares owned multiplied by the number of directors to be elected. This method of voting is called cumulative voting. Thus, if a stockholder owns 10 shares and 10 directors are to be elected, 100 votes may be cast. All 100 votes may be cast for one director. As a result, under this plan of voting the minority stockholders may have some representation on the board of directors, although still a minority.

Under a voting trust, stockholders give up their voting privileges by transferring their stock to a trustee and receiving in return voting trust certificates. This is not primarily a device to give the minority stockholders a voice on the board of directors but it does do that, and often in large corporations it gives them a controlling voice. Twenty percent of the stock always voted as a unit has more effect than individual voting. State laws frequently imposed limitations on voting trust, as by limiting the number of years that they may run.

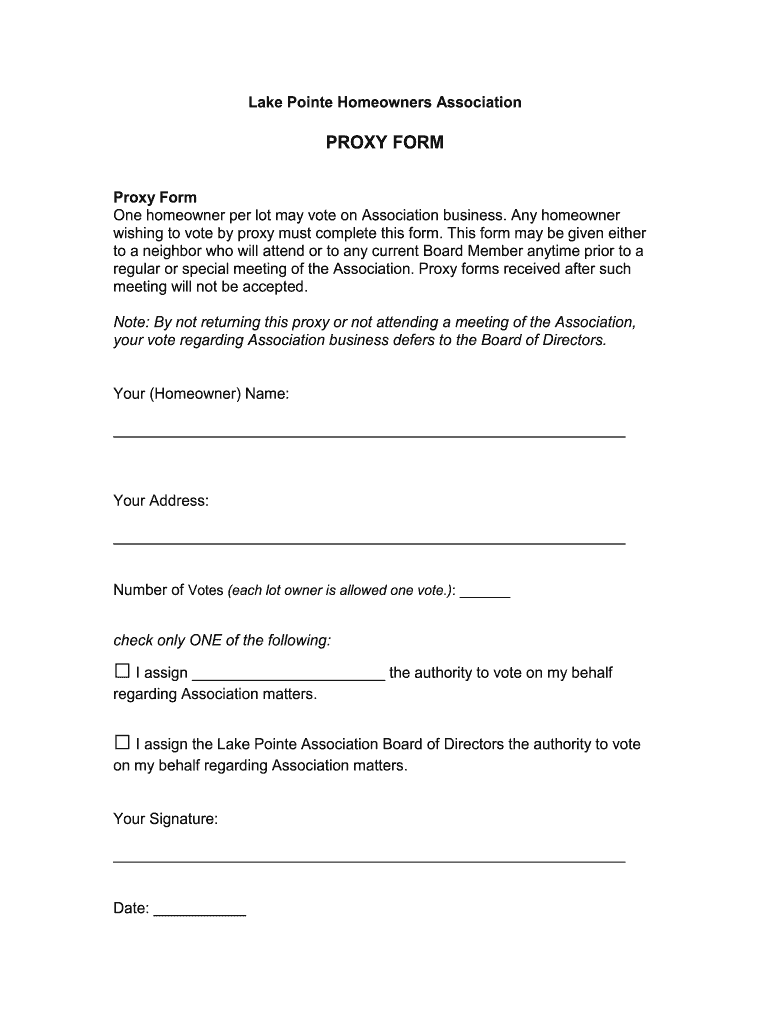

Absentee Voting. Under the common law only stockholders who were present in person were permitted to vote. Under the statutory law, the articles of incorporation, or the bylaws, stockholders who do not wish to attend the meeting and vote in person may authorize another to vote their stock for them. The person authorized to vote for another is known as a proxy. The written authorization to vote is also called a proxy (see Illustration 2). Corporations send proxy forms to shareholders; the law does not require any special form for proxy.

ILLUSTRATION 2 Proxy

As a rule, a stockholder may revoke a proxy at any time. If a stockholder should sign more than one proxy for the same stockholders' meeting, the proxy having the later date would be effective. A proxy may be good in some states for only a limited period of time. If the stockholder attends the stockholders' meeting in person, this acts as a revocation of the proxy.

The management of a corporation may legally solicit proxies for candidates selected by the board of directors. However, the incumbent board must disclose the proposals fairly by disclosing all material facts. A fact is material if there is a substantial likelihood a reasonable shareholder would find it important in deciding how to vote. Proxy secured by means of misleading or fraudulent representations to stockholders will be disqualified.

Proxy Wars

Shareholders dissatisfied with the policies of the present board of directors can try to elect a new board. Electing a new board is often a difficult or impossible task. If one or even several people own a majority of the voting stock, the objecting stockholders cannot obtain a majority of the voting stock to ensure success. If the voting stock is widely held and no group owns a majority of the voting stock, then the objecting stockholders at least have a chance to elect a new board. To do this, this dissatisfied group must control the majority of the stock represented at a stockholders meeting. To ensure success, the leaders of the group will obtain proxies from stockholders and cannot attend the stockholders meeting in person. The current board members will also attempt to secure proxies. This is known as a proxy war. The present board of directors may in most instances pay the cost of the solicitation from corporate funds. The "outsiders" generally must bear the cost of the proxy war out of their personal funds. If there are 1 million shareholders, the cost of soliciting their proxies is enormous. For this reason proxy wars seldom happened.

*SOURCE: LAW FOR BUSINESS, 15TH ED., 2005, JANET E. ASHCROFT, J.D., PGS. 429-434*

end

|

No comments:

Post a Comment