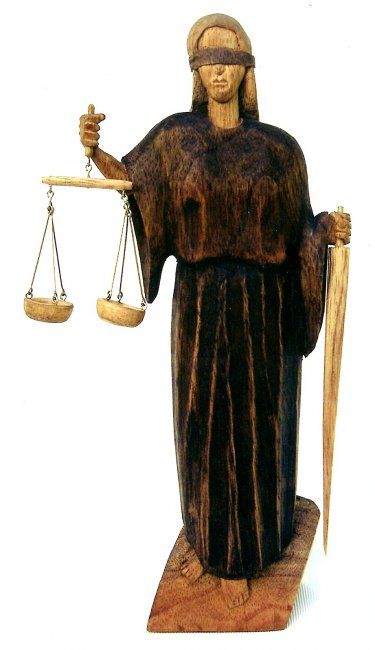

"Charity is no substitute for justice withheld."

-Saint Augustine

Management and Dissolution of a Corporation

(part B)

(part B)

by

Charles Lamson

Rights of Stockholders

The stockholders of a corporation enjoy several important rights and privileges.

| ||

|

No comments:

Post a Comment