“The most difficult thing is the decision to act, the rest is merely tenacity.”

~Amelia Earhart~

Working Capital and the Financing Decision

by

Charles Lamson

|

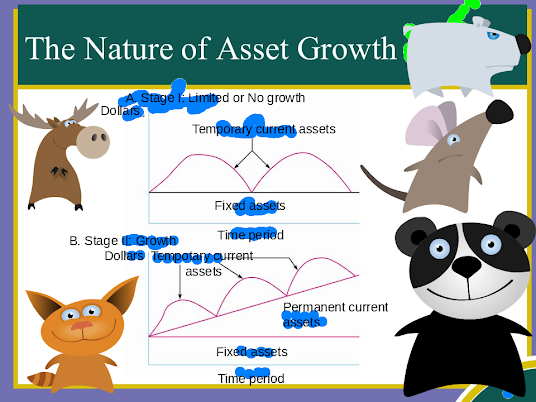

There is also the problem of seasonal sales that affect many industries such as soft drinks, toys, retail department stores, and text book publishing companies. Seasonal demand for products makes forecasting cash flows and receivables and inventory management difficult. The Internet is alleviating some of these problems and helping management make better plans. If your familiar at all with marketing, you have heard about supply chain management. Well, financial executives are also interested in the supply chain as an area where the Internet can help control work working capital through online software. McDonald's Corporation of Big Mac fame formed eMac Digital to explore opportunities in business-to-business (B2B) online ventures (Block & Hirt, 2005, p. 144). McDonald's wanted to create an online marketplace where restaurants can buy supplies online from food companies. McDonald's, like Walmart, Harley-Davidson, and Erickson has embraced supply chain management using web-based procedures. The goal is to squeeze out inefficiencies in the supply chain and thereby lower costs. One of the big benefits is a reduction in inventory through online communications between the buyer and supplier, which speeds up the ordering and delivery process and reduces the amount of inventory needed on hand. These systems may also be able to attract a large number of suppliers to bid on the company's business at more competitive prices. Working capital management involves the financing and management of the current assets of the firm. The financial executive probably devotes more time to working capital management than to any other activity. Current assets, by their very nature, are changing daily, if not hourly, and managerial decisions must be made. "How much inventory is to be carried, and how do we get the funds to pay for it?" Unlike long-term decisions, there can be no deferral of action. While long-term decisions involving plant and equipment or market strategy may well determine the eventual success of the firm, short-term decisions on working capital determine whether the firm gets to the long-term. In the next few posts, we examine the nature of asset growth, the process of matching sales and production, financial aspects of working capital management, and the factors that go into development of an optimum policy. The Nature of Asset Growth Any company that produces and sells a product, whether the product is consumer or manufacturer oriented, will have current assets and fixed assets. If a firm grows, those assets are likely to increase over time. The key to current asset planning is the ability of management to forecast sales accurately and then to match the production schedules with the sales forecast. Whenever actual sales are different from forecasted sales, unexpected buildups or reductions in inventory will occur that will eventually affect receivables and cash flow. In the simplest case, all of the firm's current assets will be self liquidating assets sold at the end of a specified time period. Assume that at the start of the summer you buy 100 tires to be disposed of by September. It is your intention that all tires will be sold, receivables collected, and bills paid over this time period. In this case your working capital current asset needs are truly short-term. Now let us begin to expand the business. In stage two you add ratios, seat covers, and batteries to your operation. Some of your inventory will again be completely liquidated, while other items will form the basic stock for your operation. Furthermore, not all items will sell. As you eventually grow to more than one store, this permanent aggregate stock of current assets will continue to increase. Problems of inadequate financing arrangements are often the result of the businessperson's failure to realize the firm is carrying not only self-liquidating inventory, but also the anomaly of permanent current assets. The movement from stage 1 to Stage 2 of growth for a typical business is depicted in Figure 1. In Panel A the buildup in current assets is temporary---while in Panel B, part of the growth and current assets is temporary and part is permanent. Fixed assets are included in the illustrations, but they are not directly related to the present discussion. Figure 1 *MAIN SOURCE: BLOCK & HIRT, 2005, FOUNDATIONS OF FINANCIAL MANAGEMENT, PP. 144-146* end |

No comments:

Post a Comment