Current Asset Management (Part B)

by

Charles Lamson

Management of Accounts Receivable

|

Accounts Receivable as an Investment

As is true of other current assets, accounts receivable should be thought of as an investment. The level of accounts receivable should not be judged too high or too low based on historical standards of industry norms, but rather the test should be whether the level of return we are able to earn from this asset equals or exceeds the potential gain from other investments. For example, if we allow our customers 5 extra days to clear their accounts, our accounts receivable balance will increase---draining funds from marketable securities and perhaps drawing down the inventory level. We must ask whether we are optimizing our return, in light of appropriate risk and liquidity considerations. An example of a buildup in accounts receivable is presented in Figure 7, with supportive financing provided through reducing lower-yielding assets and increasing lower-cost liabilities. Figure 7 Financing growth in accounts receivable Credit Policy Administration And considering the extension of credit, there are three primary policy variables to consider in conjunction with our profit objective.

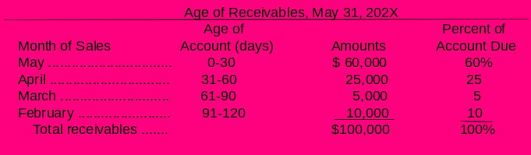

Credit Standards The firm must determine the nature of the credit risk on the basis of prior records of payment, financial stability, current net worth, and other factors. When an account receivable is created, credit has been extended to the customer who is expected to repay according to the terms of trade. Bankers sometimes refer to the 5 C's of credit (character, capital, capacity, conditions, and collateral) as an indication of whether a loan will be repaid on time, late, or not at all. Character refers to the moral and ethical quality of the individual who is responsible for paying the loan. A person of principle or a company run by people of high ethical standards is expected to be a good credit risk. A decision on character is a judgment call on the part of the lender and is considered one of the most significant considerations when making a loan. Capital is the level of financial resources available to the company seeking the loan and involves an analysis of debt to equity in the firm's capital structure. Capacity refers to the availability and sustainability of the firm's cash flow at a level high enough to pay off the loan. Conditions refers to the sensitivity of the operating income and cash flows to the economy. Some Industries such as automobiles, chemicals, and paper are quite cyclical and exhibit wide what fluctuations in cash flows as the economy moves through the economic cycle of contraction and expansion. The more sensitive the cash flow to the economy, the more the credit risk of the firm. When the economy is in a recession, business health in general is weaker, and most firms are riskier. Collateral is determined by the assets that can be pledged against the loan. Much like an automobile serves as collateral for a car loan or a house for a mortgage, companies can pledge assets that are available to be sold by the lender if the loan is not repaid. Obviously, the better the quality of the collateral, the lower the risk of the loan. Terms of Trade The stated terms of credit extension will have a strong impact on the eventual use of the accounts receivable balance. If a firm averages $5,000 in daily credit sales and allows 30-day terms, the average accounts receivable balance will be $150,000. If customers are carried for 60 days, we must maintain $300,000 in receivables and much additional financing will be required. Collection policy In assessing collection policy, a number of quantitative measures may be applied to the credit department of the firm. An increase in the average collection period may be the result of a predetermined plan to expand credit terms or the consequence of poor credit administration. An increasing ratio may indicate too many leaked accounts or an aggressive market expansion policy. Aging of accounts receivable is one way of finding out if customers are paying their bills within the time prescribed in the credit terms. If there is a buildup in receivables beyond normal credit terms, cash inflows will suffer and more stringent credit terms and collection procedures may have to be implemented. An aging schedule is presented below to illustrate the concept. If the normal credit terms are thirty days, the firm is doing something wrong because 40% of accounts are overdue with 10% over 90 days outstanding. An Actual Credit Decision We now examine a credit decision that brings together the various elements of accounts receivable management. Assume a firm is considering selling to a group of customers that will bring $10,000 in new annual sales, of which 10% will be uncollectible. While this is a very high rate of non-payment, the critical question is, what is the potential contribution to profitability? Assume the collection cost on these accounts is 5 percent and the cost of producing and selling the product is 77 percent of the sales dollar. We are in a 40 percent tax bracket. The profit on new sales is as follows: Though the return on sales is only 4.8% ($480/$10,000), the return on invested dollars may be considerably higher. Let us assume the only new investment in this case is a buildup in accounts receivable. Present working capital and fixed assets are sufficient to support the higher sales level. Assume an analysis of our accounts indicates a turnover ratio of 6 to 1 between sales and accounts receivable $667. Our new accounts receivable balance will average $1,667. Thus we are committing an average investment of only $1,667 to provide an after tax return of $480 so that the yield is a very attractive 28.8 percent. If the firm had a minimum required after tax return of 10 percent, this would clearly be an acceptable investment. We might ask next if we should consider taking on 12 percent or even 15 percent in uncollectible accounts remaining loyal to our concept of maximizing return on investment and forsaking any notion about risky accounts being inherently good or bad. *MAIN SOURCE: BLOCK & HIRT, 2005, FOUNDATIONS OF FINANCIAL MANAGEMENT, 11TH ED., PP. 188-194* end |

No comments:

Post a Comment