Dividend Policy and Retained Earnings

(Part D)

by

Charles Lamson

|

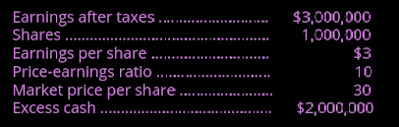

Stock Splits

A stock split is similar to a stock dividend, only more shares are distributed. For example, a two-for-one stock split would double the number of shares outstanding. In general, the rules of the New York Stock Exchange and the Financial Accounting Standards Board encourage distributions in excess of 20 to 25 percent to be handled as stock splits. The accounting treatment for a stock split is somewhat different from that for a stock dividend too, in that there is no transfer of funds from retained earnings to the capital accounts but merely a reduction in par value and a proportionate increase in the number of shares outstanding. For example, a two-for-one stock split for the XYZ Corporation would necessitate the accounting adjustments shown in Table 5. Table 5 XYZ Corporation before and after stock split In this case all adjustments are in the common stock account. Because the number of shares is doubled and the par value halved, the market price of the stock should drop proportionately. There has been much discussion in the financial literature about the impact of a split on overall stock value. While there might be some positive benefit, that benefit is virtually impossible to capture after the split has been announced. Perhaps a $66 stock will drop only to $36 after a two-for-one split, but one must act very early in the process to benefit. The primary purpose of a stock split is to lower the price of a security into a more popular trading range. A stock selling for over $100 per share may be excluded from consideration by many small investors. Splits are also popular because only stronger companies that have witnessed substantial growth in market price are in a positive position to participate in them. Reverse Stock Splits In the case of a reverse stock split, a firm exchanges fewer shares for existing shares with the intent of increasing the stock price. An example might be a one-for-four reverse stock split in which you would get one new share in place of four old shares. A stockholder who held 100 shares would now own 25. With total earnings unaffected by the reverse stock split, earnings per share should increase fourfold because there would be only one fourth as many shares outstanding. It is also hoped that the stock price will increase fourfold. Perhaps, you originally had 100 shares at $2 per share and now you have 25 shares at $8. The stock price does not always increase by a commensurate amount. Keep in mind that a reverse stock split is normally used by firms whose stock has plummeted in value. The announcement of a reverse stock split may represent further evidence that the firm is having problems. One useful purpose of a reverse stock split is to attempt to place a stock's value at a level that is acceptable to the New York Stock Exchange, the American Stock Exchange, or the NASDAQ for trading purposes. All three will delist a stock if its value remains under $1 for an extended period of time (such as six months). Repurchase of Stock as an Alternative to Dividends A firm with excess cash may choose to make a corporate stock repurchase of its own shares in the market, rather than pay a cash dividend. For this reason, the stock purchase decision may be thought of as an alternative to the payment of cash dividends. The benefits of the stockholder are equal under either alternative, at least in theory. For purposes of our discussion assume the Lamson Corporation's financial position is described by the data in Table 6. Table 6 Financial Data of Lamson Corporation Assume the firm is considering a repurchase of its own shares in the market. The firm has $2 million in excess cash, and it wishes to compare the value to stockholders of a $2 cash dividend (on the million shares outstanding) as opposed to spending the funds to repurchase shares in the market. If the cash dividend is paid, the million may be used to repurchase shares at slightly over market value (to induce sale). The overall benefit to stockholders is that earnings per share will go up as the number of shares outstanding is decreased. If the price earnings ratio of the stock remains constant, then the price of the stock should also go up. If a purchase price of $32 is used to induce sale, then 62,500 shares will be purchased. Total shares outstanding are reduced to 937500 (1 million - 62,500). Revised earnings per share for the Lamson Corporation become: Since the price earnings ratio for the stock is $10, the market value of the stock should go to $32. Thus we see that the consequences of the two alternatives are presumed to be the same as shown in the following: In either instance the total value is presumed to be $32. Theoretically, the stockholder would be indifferent with respect to the two alternatives. Other Reasons for Repurchase In addition to using the repurchase decision as an alternative to cash dividends, corporate management may acquire its own shares in the market, because it believes they are selling at a low price. A corporation president who sees his firm's stock decline by 25 to 30 percent over a six month period may determine the stock is the best investment available to the corporation. By repurchasing shares the corporation can maintain a constant demand for its own securities and, perhaps, stave off further decline. Stock repurchases by corporations were partially credited with stabilizing the stock market after the 508-point crash on October 19th, 1987 (Block & Hirt, p. 545). In many cases companies may take years to complete stock repurchases, and they may time the repurchase depending on stock price behavior. Reacquired shares may also be used for employee stock options or as part of a tender offer in a merger. A firm may also reacquire part of its shares as a protective device against being taken over as a merger candidate. There is one caveat for firms that continually repurchase their own shares. Some analysts may view the action as a noncreative use of funds. The analysts may say, "Why aren't the funds being used to develop new products or to modernize plant and equipment?" Thus it is important that the corporation carefully communicate the reason(s) for the repurchase decision to analysts and shareholders---such as the fact that the stock is a good buy at its current price. Dividend Reinvestment Plans Years ago, many companies started dividend reinvestment plans for their shareholders, these plans take various forms, but basically they provide the investor with an opportunity to buy additional shares of stock with the cash dividend paid by the company. Some plans will sell treasury stock or authorized but unissued shares to the stockholders. With this type of plan the company is the beneficiary of increased cash flow, since dividends paid are returned to the company for reinvestment in common stock, these types of plans have been popular with cash-short public utilities, and often public utilities will allow shareholders a 5 percent discount from market value at the time of purchase. This is justified because no investment banking or underwriting fees need to be paid. Under a second popular dividend reinvestment plan, the company's transfer agent, usually a bank, buys shares of stock in the market for the stockholder. This plan provides no cash flow for the company; but it is a service to the shareholder, who benefits from much lower transaction costs, the right to own fractional shares, and more flexibility in choosing between cash and common stock. Usually a shareholder can also add cash payments of between $500 and $1,000 per month to his or her dividend payments and receive the same lower transaction costs. Shareholder accounts are kept at the bank, and quarterly statements are provided. Summary In choosing either to pay a dividend to stockholders or to reinvest the funds in the company, management's first consideration is whether the firm will be able to earn a higher return for the stockholders. However, we must temper this "highest return theory" with a consideration of stockholder preferences and the firm's need for earnings retention and growth as presented in the life cycle growth curve. Dividends provide information content to shareholders. An increase in the dividend is generally interpreted as a positive signal while dividend cuts are negative, and shareholders generally prefer dividend stability. The dividend payout ratio (dividends/earnings) often signals where a firm is in its life cycle stage. During the initial stages, dividends will be small or non-existent, while in the later stages, dividends normally increase. Other factors influencing dividend policy are legal rules relating to maximum payments, the cash position of the firm, the firm's access to capital markets, and management's desire for control. An alternative (or a supplement) to cash dividends maybe the use of stock dividends and stock splits. While neither of these financing devices directly changes the intrinsic value of the stockholders position, they may provide communication to stockholders and bring the stock price into a more acceptable trading range. A stock dividend may take on actual value when total cash dividends are allowed to increase. Nevertheless, the alert investor will watch for abuses of stock dividends---situations in which the corporation indicates that something of great value is occurring when, in fact, the new shares that are created merely represent the same proportionate interest for each shareholder. *MAIN SOURCE: BLOCK & HIRT, 2005, FOUNDATIONS OF FINANCIAL MANAGEMENT, 11TH ED., PP. 542-547* end |

No comments:

Post a Comment