Monopoly and Antitrust Policy (Part E)

by

Charles Lamson

Price Discrimination

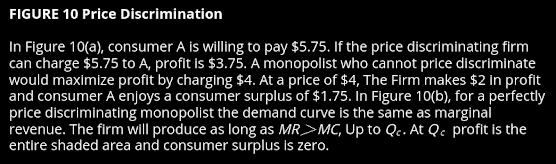

So far in our discussion of monopoly we have assumed that the firm faces a known downward-sloping demand curve and must choose a single price and a single quantity of output. Indeed, the reason that price and marginal revenue are different for a monopoly and the same for a perfectly competitive firm is that if a monopoly decides to sell more output, it must lower price in order to do so. In the world, however, there are lots of examples of firms that charge different prices to different groups of buyers. Charging different prices to different buyers is called price discrimination. The motivation for price discrimination is fairly obvious: If a firm can identify those who are willing to pay a higher price for a good, it can earn more profit from them by charging a higher price. The idea is best Illustrated using the extreme case where a firm knows what each buyer is willing to pay. A firm that charges the maximum amount that buyers are willing to pay for each unit is practicing perfect price discrimination. Examples of Price Discrimination Examples of price discrimination are all around us. Airlines routinely charge those who stay over Saturday nights a much lower fair than those who do not. Business travelers generally travel during the week, often are unwilling to stay over Saturdays, and generally are willing to pay more for tickets. Airlines, movie theaters, hotels, and many other industries routinely charge a lower price for children and the elderly. This is because children and the elderly generally have a lower willingness-to-pay. Telephone companies have so many ways of getting at different groups that it is difficult to know what they are really charging! In each case, the objective of the firm is to segment the market in two different identifiable groups, with each group having a different elasticity of demand. It can be shown, although we will not present the analysis here, that the optimal strategy for a firm that can sell in more than one market is to charge higher prices in markets with low demand elasticities [Elasticity of demand refers to the degree in the change in demand when there is a change in another economic factor, such as price or income. If demand for a good or service remains unchanged even when the price changes, demand is said to be inelastic (investopdia.com)]. *CASE & FAIR, 2004, PRINCIPLES OF ECONOMICS, 7TH ED., PP. 268-269* end |

No comments:

Post a Comment