The scriptures make the danger of delay clear. It is that we may discover that we have run out of time. The God who gives us each day as a treasure will require an accounting.

Accounting for Merchandising Businesses

(Part E)

by

Charles Lamson

|

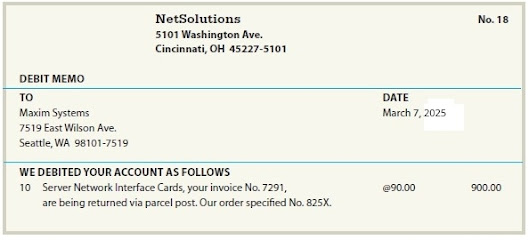

Purchase Transactions

As indicated in an earlier post, most large retailers and many small merchandising businesses use computerized perpetual inventory systems. Under the perpetual inventory system, cash purchases of merchandise are recorded as follows: Purchases of merchandise on account are recorded as follows: Purchases Discounts Purchases discounts taken by the buyer for early payment of an invoice reduce the cost of the merchandise purchased. Most businesses design their accounting systems so that all available discounts are taken. Even if the buyer has to borrow to make the payment within a discount, it is normally to the buyer's advantage to do so. To illustrate, assume that Alpha Technologies issues an invoice for $3,000 to NetSolutions, dated March 12, with terms 2/10, n/30 (2% discount if paid within 10 days, net amount due within 30 days). The last day of the discount. In which the $60 discount can be taken is March 22. Assume that in order to pay the invoice on March 22, NetSolutions borrows the money for the remaining 20 days of the credit period. If we assume an annual interest rate of 6% and a 360-day year (A calendar year with 365 or 366 days does not divide evenly across the 12 months so it became standard practice to record interest on accounts payable using a 360-day year, treating each month as 30 days. This method of calculating interest is called the accrual convention.), the interest on the loan of $2,940 ($3,000 - $60) is $9.80 ($2,940 * 6% X 20 / 360). The net savings to NetSolutions is $50.20, computed as follows: The savings can also be seen by comparing the interest rate on the money saved by taking the discount and the interest rate on the money borrowed to take the discount. For NetSolutions, the interest rate on the money saved in this example is estimated by converting 2% for 20 days to a yearly rate, as follows: If NetSolutions borrows the money to take the discount, it pays interest of 6%. If NetSolutions does not take the discount, it pays estimated interest of 36% for using the $60 for an additional 20 days. Under the perpetual inventory system, the buyer initially debits the merchandise inventory account for the amount of the invoice. When paying the invoice, the buyer credits the merchandise inventory account for the amount of the discount. In this way, the merchandise inventory shows the net cost to the buyer. For example, Netsolutions would record the Alpha Technologies invoice and it's payment at the end of the discount period as follows: If NetSolutions does not take the discount because it does not pay the invoice until April 11, it would record the payment as follows: Purchases Returns and Allowances When merchandise is returned (purchases return) or a price adjustment is requested (purchases allowance) , the buyer (debtor) usually sends the seller a letter or a debit memorandum. A debit memorandum, shown in Exhibit 9, informs the seller of the amount the buyer proposes to debit to the account payable due the seller. It also states the reasons for the return or the request for a price reduction. EXHIBIT 9 Debit Memorandum The buyer may use a copy of the debit memorandum as the basis for recording the return or allowance or wait for approval from the seller (creditor). In either case, the buyer must debit Accounts Payable and credit Merchandise Inventory. To illustrate, NetSolutions records the return of the merchandise indicated in the debit memo in Exhibit 9 as follows: When a buyer returns merchandise or has been granted an allowance prior to paying the invoice, the amount of the debit memorandum is deducted from the invoice amount. The amount is deducted before the purchase discount is computed. For example, assume that on May 2, NetSolutions purchases $5,000 of merchandise from Delta Data Link, subject to terms 2/10, n/30. On May 4, NetSolutions returns $3,000 of the merchandise, and on May 12, NetSolutions pays the original invoice less the return. NetSolutions would record these transactions as follows: *WARREN, REEVE, & FESS, 2005, ACCOUNTING, 21ST ED., PP. 242-244* end |

No comments:

Post a Comment