Mission Statement

Thursday, June 30, 2022

Accounting: The Language of Business - Vol. 1 (Part 118)

Process Cost Systems (Part E)

by

Charles Lamson

Average Cost Method

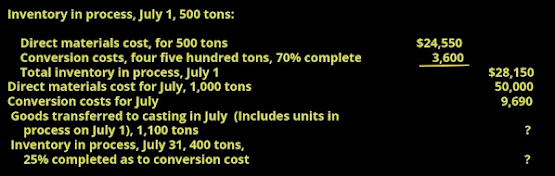

A manufacturer uses a cost flow assumption in determining the costs flowing into, out of, and remaining in each manufacturing department. In preceding posts, we illustrated the first-in, first-out cost flow assumption for the Melting Department of McDermott Steel Inc. In this post, we illustrate the average cost flow method for Gemini Steel Corporation. Determining Costs Under the Average Cost Method Gemini's operations are similar to those of McDermott Steel in that Gemini melts scrap metal and then pours the molten metal into an ingot casting. Like McDermott Steel, Gemini has two manufacturing departments, melting and casting. To illustrate the average cost method, we simplify by using only the Melting Department of Gemini Steel. The manufacturing data for the Melting Department for July 2023 are as follows. Using the average cost method, our objective is to allocate the total costs of production of $86,400 to the 1,100 tons completed and transferred to the casting department and the costs of the remaining 400 tons in the ending work in process inventory. These costs are represented in the preceding table by two question marks. We determine these amounts by using the following four steps:

Step 1: Determine the Units to be Assigned Costs The first step in our illustration is to determine the units to be assigned costs. A unit can be any measure of completed production, such as tons, gallons, pounds, barrels, or cases. We use tons as the definition for units in Gemini Steel. Gemini Steel's Melting Department had 1,500 tons of direct materials to account for during July, as shown here: There are two categories of units to be assigned costs for the periods: (1) units completed and transferred out and (2) units in the ending work in process inventory. During July, the Melting Department completed and transferred 1,100 tons to the Casting Department. Of the 1,000 tons started in July, 600 tons were completed and transferred to the Casting Department. Thus, the ending work in process inventory consists of 400 tons. Note that the total units (tons) to be assigned costs (1,500 tons) equals the total units to account for (1,500 tons). Step 2: Calculate Equivalent Units of Production Gemini Steel has 400 tons of whole units in the work in process inventory for the Melting Department on July 31. Since these units are 25% complete, the number of equivalent units in process in the Melting Department on July 31 is 100 tons (400 tons * 0.25). Since the units transferred to the Casting Department have been completed, the whole units (1,100 tons) transferred are the same as the equivalent units transferred. The total equivalent units of production for the melting department is determined by adding the equivalent units and the ending work in process inventory to the units transferred and completed during the period as shown here: Step 3: Determine the Cost per Equivalent Unit Materials and conversion costs are often combined in computing cost per equivalent unit under the average cost method. In doing so, the cost per equivalent unit is determined by dividing the total production costs by the total equivalent units of production as follows: We use the cost per equivalent unit in Step 4 to allocate the production costs to the completed and partially completed units. Step 4: Allocate Costs to Transferred and Partially Completed Units In Step 4, we multiply the cost per equivalent unit by the equivalent units of production to determine the cost of transferred and partially completed units. For the Melting Department, these costs are determined as shown: The Cost of Production Report The July cost of production reports for Gemini Steel's Mining Department is shown in Exhibit 11. The cost of production report in Exhibit 11 summarizes the following:

EXHIBIT 11 Cost of Production Report for Gemini Steel's Melting Department *WARREN, REEVE, & FESS, 2005, ACCOUNTING, 21ST ED., PP. 799-802* end |

Wednesday, June 29, 2022

Tuesday, June 28, 2022

Accounting: The Language of Business - Vol. 1 (Part 117)

Process Cost Systems (Part D)

by

Charles Lamson

Using the Cost of Production Report for Decision Making

The cost of production report is one source of information that may be used for managers to control and improve operations. A cost of production report will formally list costs in greater detail than in Exhibit 7 (from part 116). This greater detail helps management isolate problems and opportunities. To illustrate, assume that the Blending Department of Holland Beverage Company prepared cost of production reports for April and May. In addition, assume that the Blending Department had no beginning or ending work in process inventory either month. Thus, in this simple case, there is no need to determine equivalent units of production for allocating costs between completed and partially completed units. The cost of production reports for April and May in the Blending Department are as follows: Note that the preceding reports provide more cost detail than simply reporting direct materials and conversion costs. The May results indicate that total unit costs have increased from $0.50 to $0.53 cents, or 6% from the previous month. What caused this increase? To determine the possible causes for this increase, the cost of production report may be restated in per-unit terms, as shown below. Both energy and tank cleaning per unit costs have increased dramatically in May. Further investigation should focus on these costs. For example, an increasing trend in energy may indicate that the machines are losing fuel efficiency, thereby requiring the company to purchase an increasing amount of fuel. This unfavorable trend could motivate management to repair the machines. The tank cleaning costs could be investigated in a similar fashion. In addition to unit production cost trends, managers of process manufacturers are also concerned about yield trends. Yield is the ratio of the materials output quantity to the input quantity. A yield less than one occurs when the output quantity is less than the input quantity due to materials losses during the process. For example, if 1,000 pounds of sugar enter the packing operation, and only 980 pounds of sugar were packed, the yield would be 98%. Two Percent or 20 pounds of sugar were lost or spilled during the packing process. Just-in-Time Processing The objective of many companies is to produce products with high-quality, low-cost, and instant availability. One approach to achieving this objective is to implement just-in-time processing. Just-in-time processing (JIT) is a philosophy that focuses on reducing time and cost and eliminating poor quality. A JIT system achieves production efficiencies and flexibility by reorganizing the traditional production process. In a traditional production process (illustrated in Exhibit 9), a product moves from process to process as each function or step is completed. Each worker is assigned a specific job, which is performed repeatedly as unfinished products are received from the preceding department. For example, a furniture manufacturer might use seven production departments to perform the operating functions necessary to manufacture furniture, as shown in the diagram in Exhibit 9. For the furniture maker in the illustration, manufacturing would begin in the Cutting Department, where the wood would be cut to design specifications. Next, the Drilling Department would perform the drilling function, after which the Sanding Department would sand the wood, the Staining Department would stain the furniture, and the Varnishing Department would apply varnish and other protective coatings. Then, the Upholstery Department would add fabric and other materials. Finally, the Assembly Department would assemble the furniture to complete the process. In the traditional production process, production supervisors attempt to enter enough materials into the process to keep all the manufacturing departments operating. Some departments, however, may process materials more rapidly than others. In addition, if one department stops production because of machine breakdowns, for example, the preceding departments usually continue production in order to avoid idle time. This may result in a buildup of work in process inventories in some departments. In a just-in-time system, processing functions are combined into work centers, sometimes called manufacturing cells. For example, the seven departments illustrated above for the furniture manufacturer might be reorganized into three work centers. As shown in the diagram in Exhibit 10, Work Center One would perform the cutting, drilling, and sanding functions, Work Center Two would perform the staining and varnishing functions, and Work Center Three would perform the upholstery and assembly functions. In the traditional production line, a worker typically performs only one function. However, in a work center in which several functions take place, the workers are often cross trained to perform more than one function. Research has indicated that workers who perform several manufacturing functions identify better with the end product. This creates pride in the product and improves quality and productivity. Implementing JIT may also result in reorganizing service activities. Specifically, the service activities may be assigned to individual work centers, rather than to centralized service departments. For example, each work center may be assigned the responsibility for the repair and maintenance of its machinery and equipment. Accepting this responsibility creates an environment in which workers gain a better understanding of the production process and the machinery. In turn, workers tend to take better care of the machinery, which decreases repairs and maintenance costs, reduces machine downtime, and improves product quality. In a JIT system, wasted motion from moving the product and materials is reduced. The product is often placed on a movable carrier that is centrally located in the work center. After the workers in a work center have completed their activities with the product, the entire carrier and any additional materials are moved just in time to satisfy the demand or need of the next work center. In this sense, the product is said to be "pulled through." Each work center is connected to other work centers through information contained on Kanbans, which is the Japanese term for cards. The experience of Caterpillar Inc., illustrates the impact of JIT. Before implementing JIT, an average transmission would travel 10 miles through the factory and require 1,000 pieces of paper for materials, labor, and movement transactions. After implementing JIT, caterpillar improved manufacturing so that an average transmission traveled only 200 feet and required only 10 pieces of paper (Warren, Reeve, & Fess, 2005). In summary, the primary benefit of JIT systems is the increased efficiency of operations, which is achieved by eliminating waste and simplifying the production process. At the same time, JIT systems emphasize continuous improvement in the manufacturing process and the improvement of product quality. *WARREN, REEVE, & FESS, 2005, ACCOUNTING, 21ST ED., PP. 796-799* end |

Sunday, June 26, 2022

Accounting: The Language of Business - Vol. 1 (Part 116)

Process Cost System (Part C)

by

Charles Lamson

|

Bringing It All Together: The Cost of Production Report

A cost of production report is normally prepared for each processing department at periodic intervals. The July cost of production report for McDermott Steel's Melting Department is shown in Exhibit 7. As can be seen on the report, the two question marks (from part 115 and reintroduced above) can now be determined. The cost of goods transferred to the Casting Department in July was $66,700, while the cost of the ending work in process in the Melting Department on July 31 is $21,140. EXHIBIT 7 Cost of Production Report for McDermott Steel's Melting Department---FIFO The report summarizes the four previous steps (from part 115) by providing the following production quantity and cost data:

The cost of production report is also used to control costs. Each department manager is responsible for the units entering production and the costs incurred in the department. Any failure to account for all costs and any significant differences in unit product cost from one month to another should be investigated. Journal Entries for a Process Cost System To illustrate the journal entries to record the cost flows in a process costing system, we will use the July transactions for McDermott Steel. The entries in summary form for those transactions are shown below. In practice, the transactions would be recorded daily. Exhibit 8 shows the flow of costs for each transaction. Note that the highlighted amounts in Exhibit 8 were determined from assigning the costs charged to production in the Melting Department. These amounts were computed and are shown at the bottom of the cost of production report for the Melting Department in Exhibit 7. Likewise, the amount transferred out of the Casting Department to Finished Goods would have been determined from a cost of production report for the Casting Department. EXHIBIT 8 McDermott Steel's Cost Flows *WARREN, REEVE, & FESS, 2005, ACCOUNTING, 21ST ED., PP. 794-796* end |

Saturday, June 25, 2022

Friday, June 24, 2022

Thursday, June 23, 2022

Accounting: The Language of Business - Vol. 1 (Part 115)

Process Cost System (Part B)

by

Charles Lamson

|

The First-In, First-Out (Fifo) Method

In a process cost system, the accountant determines the cost transferred out and thus the amount remaining in inventory for each department. To determine this cost, the accountant must make a cost flow assumption. Like merchandise inventory, costs can be assumed to flow through the manufacturing process using the first in, first out (fifo) or average cost methods. Because the first-in, first-out (fifo) method is often the same as the physical flow of units, we use the fifo method in the next several posts. Most process manufacturers have more than one department. In the illustrations that follow, McDermott Steel Inc. has two departments, Melting and Casting. McDermott melts scrap metal and then pours the molten metal into an ingot casting. To illustrate the first in, first out method, we will simplify by using only the Melting Department of McDermott Steel Inc. The following data for the Melting Department are for July 2023: We assume that all materials used in the department are added at the beginning of the process, and conversion costs (direct labor and factory overhead) are incurred evenly throughout the melting process. The objective is to determine the cost of goods completed and the ending inventory valuation, which are represented by the question marks. We determine these amounts by using the following four steps:

Step 1: Determine the Units to Be Assigned Costs The first step in our illustration is to determine the units to be assigned costs. A unit can be any measure of completed production such as tons, gallons, pounds, barrels, or cases. We use tons as the definition for units in McDermott Steel. McDermott Steel had 1,500 tons of direct materials charged to production in the Melting Department for July, as shown below. There are three categories of units to be assigned costs for an accounting period: (A) units in beginning in-process inventory, (B) units started and completed during the period, and (C) units in ending in-process inventory. Exhibit 4 illustrates these categories in the Melting Department for July. The 500-ton beginning inventory (A) was completed and transferred to the Casting Department. McDermott Steel started another 1,000 tons of material into the process during July. Of the 1,000 tons introduced in July, 400 tons were left incomplete at the end of the month (C). Thus, only 600 of the 1,000 tons were actually started and completed in July (B). EXHIBIT 4 July Units to Be Costed---Melting Department The total units (tons) to be assigned costs for McDermott Steel can be summarized as shown below. Note that the total tons to be assigned costs equals the total tons accounted for by the department. The 3 unit categories (A, B, and C) are used in the remaining steps to determine the cost transferred to the Casting Department and the cost remaining in work in process inventory at the end of the period. Step 2: Calculate Equivalent Units of Production Process manufacturers often have some partially processed materials remaining in production at the end of the period. In these cases, the costs of production must be allocated between the units that have been completed and transferred to the next process (or finished goods) and those that are only partially completed and remain within the department. This allocation can be determined by using the equivalent units of production. The equivalent units of production are the number of units that could have been completed within a given accounting period. In contrast, whole units are the number of units in production during a period, whether or not completed. For example, assume that 400 whole units are in work in process at the end of a period. If the units are 25% complete, the number of equivalent units in process is 100 (400 * 25%). Equivalent units for materials and conversion costs are usually determined separately because they are often introduced at different times or in different rates in the production process. In contrast, direct labor and factory overhead are combined together as conversion costs because they are often incurred in production at the same time and rate. Materials Equivalent Units To allocate materials costs between the completed and partially completed units, it is necessary to determine how materials are added during the manufacturing process. In the case of McDermott Steel, the materials are added at the beginning of the melting process. In other words, the melting process cannot begin without the scrap metal. The equivalent unit computation for materials in July is as follows: The whole units from Step 1 are multiplied by the percentage of materials that are added in July for the in-process inventories and units started and completed. The equivalent units for direct materials are Illustrated in Exhibit 5. EXHIBIT 5 Direct Materials Equivalent Units The direct materials for the 500 tons of July 1 in process inventories were introduced in June. Thus, no materials units were added in July for the inventory in process on July 1. All of the 600 tons started and completed in July were 100% complete with respect to materials. Thus, 600 equivalent units of materials were added in July. All the materials for the July 31 in-process inventory were introduced at the beginning of the process. Thus, 400 equivalent units of material for the July 31 in-process inventory were added in July. Conversion Equivalent Units The conversion costs are usually incurred evenly throughout a process. For example, direct labor, utilities, and machine depreciation are usually used uniformly during processing. Thus, the conversion equivalent units are added in July in direct relation to the percentage of processing completed in July. The computations for July are as follows: The whole units from Step 1 are multiplied by the percentage of conversion completed in July for the in-process inventories and units started and completed. The equivalent units for conversion are Illustrated in Exhibit 6. The conversion equivalent units of the July 1 in-process inventory are 30% of the five hundred tons, or 150 equivalent units. Since 70% of the conversion had been completed on July 1, only 30% of the conversion effort for these tons was incurred in July. All the units started and completed used converting effort in July. Plus, conversion equivalent units are 100% of these tons. The equivalent units for the July 31 in process inventory are 25% of the 400 tons because only 25% of the converting has been completed with respect to these tons in July. Step 3: Determine the Cost per Equivalent Unit In Step 3, we calculate the cost per equivalent unit. The July equivalent unit totals for McDermott Steel's Melting Department are reproduced from Step 2 as follows: The cost per equivalent unit is determined by dividing the direct materials and conversion costs incurred in July by the respective total equivalent units for direct materials and conversion costs. The direct materials and conversion costs were given at the beginning of this illustration. These calculations are as follows: We will use these rates in Step 4 to allocate the direct materials in the conversion cost to the completed and partially completed units. Step 4: Allocate Costs to Transferred and Partially Completed Units In Step 4, we multiply the equivalent unit rates by their respective equivalent units of production in order to determine the cost of transferred and partially completed units. The cost of the July 1 in-process inventory, completed and transferred out to the Casting Department, is determined as follows: The July 1 in-process inventory cost of $28,150 is carried over from June and will be transferred to Casting. The cost required to finish the July 1 in-process inventory is $1,710, which consists of conversion costs required to complete the remaining 30% of the processing. This total does not include direct materials costs, since these costs were added at the beginning of the process in June. The conversion costs required to complete the beginning inventory are added to the balance carried over from the previous month to yield a total cost of the completed July 1 in-process inventory of $29,860. The 600 units started and completed in July receive 100% of their direct materials and conversion costs in July. The costs associated with the units started and completed are determined by multiplying the equivalent units in Step 2 by the unit costs in Step 3, as follows: The total cost transferred to the Casting Department is the sum of the beginning inventory cost from the previous period ($28,150), the additional costs incurred in July to complete the beginning inventory ($1,710), and the costs incurred for the units started and completed in July ($36,840). Thus, the total cost transferred to Casting is $66,700. The units of ending inventory have not been transferred, so they must be valued at July 31. The costs associated with the partially completed units in the ending inventory are determined by multiplying the equivalent units in Step 2 by the unit costs in Step 3, as follows: The units in the ending inventory have received 100% of their materials in July. Thus, the materials cost incurred in July for the ending inventory is $20,000, or 400 equal amount units of materials multiplied by $50. The conversion costs incurred in July for the ending inventory is $1,140 which is 100 equivalent units of the conversion (400 units, 25% complete) for the ending inventory multiplied by $11.40. Summing the conversion and materials costs, the total ending inventory cost is $21,140. *WARREN, REEVE, & FESS, 2005, ACCOUNTING, 21ST ED., PP. 788-793* end |

-

That's what hip-hop is: It's sociology and English put to a beat, you know. Talib Kweli Inequalities of Social Class (...

-

I'm double majoring in social studies - which is sociology, anthropology, economics, and philosophy - and African-American studies. Yara...

%20(10)%20(1)%20(1).jpg)

%20(12)%20(1)%20(2).jpg)

%20(13)%20(1)%20(2)%20(1).jpg)

%20(14)%20(1)%20(1).jpg)

%20(17)%20(1)%20(1).jpg)

%20(19)%20(1)%20(1).jpg)

%20(8)%20(1)%20(1).jpg)

%20(9)%20(1)%20(3).jpg)

.jpg)

.jpg)

%20(2)%20(1)%20(1).jpg)

%20(5)%20(1).jpg)

%20(7)%20(1)%20(2).jpg)

%20(1)%20(1)%20(1)%20(2)%20(1)%20(1)%20(2).jpg)

%20(1)%20(1)%20(1)%20(2)%20(2)%20(1)%20(1).jpg)

%20(1)%20(1)%20(1)%20(2)%20(3)%20(3)%20(1)%20(1).jpg)

%20(1)%20(1)%20(1)%20(2)%20(4)%20(1)%20(1).jpg)

%20(1)%20(1)%20(1)%20(2)%20(5)%20(1)%20(1).jpg)

%20(1)%20(1)%20(1)%20(2)%20(3)%20(4)%20(2)%20(1)%20(1)%20(2)%20(1)%20(1).jpg)

%20(1)%20(1)%20(1)%20(2)%20(6)%20(1)%20(1).jpg)

%20(1)%20(1)%20(1)%20(2)%20(7)%20(1)%20(1)%20(1)%20(1).jpg)

%20(1)%20(4).jpg)

%20(1)%20(1).jpg)

%20(1)%20(1).jpg)

%20(1)%20(2).jpg)

%20(1)%20(2)%20(2)%20(2)%20(1)%20(1).jpg)