Financial Statement Analysis (Part F)

by

Charles Lamson

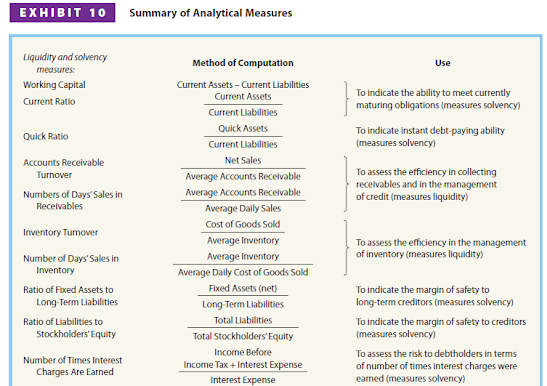

Summary of Analytical Measures

Exhibit 10 presents a summary of the analytical measures that we have discussed in the preceding posts. These measures can be computed for most medium-sized businesses. Depending on the specific business being analyzed, some measures might be omitted or additional measures could be developed. The type of industry, the capital structure, and the diversity of the business's operations usually affect the measures used. For example, analysis for an airline might include revenue per passenger mile and cost per available seat as measures. Likewise, analysis for a hotel might focus on occupancy rates. Percentage analysis, ratios, turnovers, and other measures of financial position and operating results are useful analytical measures. They are helpful in assessing a business's past performance and predicting its future. They are not, however, a substitute for sound judgment. In selecting and interpreting analytical measures, conditions peculiar to a business or its industry should be considered. In addition, the influence of the general economic and business environment should be considered. In determining trends, the interrelationship of the measures used in assessing a business should be carefully studied. Comparable indexes of earlier periods should also be studied. Data from competing businesses may be useful in assessing the efficiency of operations for the firm under analysis. In making such comparisons, however, the effects of differences in the accounting methods used by the businesses should be considered. Corporate Annual reports Corporations normally issue annual reports to their stockholders and other interested parties. Such reports summarize the corporation's operating activities for the past year and plans for the future. There are many variations in the order and form for presenting the major sections of annual reports. However, one section of the annual report is devoted to the financial statements, including the accompanying notes. In addition, annual reports usually include a management discussion and analysis (MDA) and an independent auditor's report. Management Discussion and Analysis A required disclosure in the annual report filed with the Securities and Exchange Commission is the Management Discussion and Analysis (MDA). The MDA provides critical information in interpreting the financial statements and assessing the future of the company. The MDA includes an analysis of the results of operations and discusses management's opinion about future performance. It compares the prior year's income statement with the current year's to explain changes in sales, significant expenses, gross profit, and income from operations. For example, an increase in sales may be explained by referring to higher shipment volume or stronger prices. The MDA also includes an analysis of the company's financial condition. It compares significant balance sheet items between successive years to explain changes in liquidity and capital resources. In addition, the MDA discusses significant risk exposure. Independent Auditor's Report Before using annual statements, all publicly held corporations are required to have an independent audit (examination) of their financial statements. For the financial statements of most companies, the CPAs who conduct the audit render an opinion on the fairness of the statements. In addition, the Sarbanes-Oxley Act of 2004 requires the independent auditor to provide an additional report attesting to management's assessment of internal control. This report will express the auditor's opinion on the accuracy of management's internal control assertion. *WARREN, REEVE, & FESS, 2005, ACCOUNTING, 21ST ED., PP. 708-710* end |

.jpg)

No comments:

Post a Comment