Mission Statement

Monday, July 31, 2023

Training Vlog: Day 280 of Year 2 of Operation Great Reset - Build Back B...

Sunday, July 30, 2023

Saturday, July 29, 2023

Friday, July 28, 2023

Accounting: The Language of Business - Vol 2 (Intermediate: Part 89)

When you give up vengeance, make sure you are not giving up on justice. The line between the two is faint, unsteady, and fine...Vengeance is our own pleasure of seeing someone who hurt us getting it back and then some. Justice, on the other hand, is secure when someone pays a fair penalty for wronging another even if the injured person takes no pleasure in the transaction. Vengeance is personal satisfaction. Justice is moral accounting...Human forgiveness does not do away with human justice.

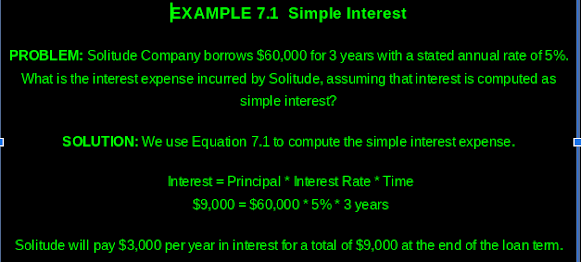

Accounting and the Time Value of Money (Part B)

by

Charles Lamson

Thursday, July 27, 2023

Training Vlog: Day 277 of Year 2 of Operation Great Reset - Build Back B...

Wednesday, July 26, 2023

Tuesday, July 25, 2023

Monday, July 24, 2023

Accounting: The Language of Business - Vol. 2 (Intermediate: Part 88)

There is no company - no corporation on earth that engages in accounting fraud to the extent the Imperial Federal Government of the United Sates does. Not many congressmen are willing to come forward with the details.

Accounting and the Time Value of Money (Part A)

by

Charles Lamson

Training Vlog: Day 274 of Year 2 of Operation Great Reset - Build Back B...

Sunday, July 23, 2023

Saturday, July 22, 2023

Wednesday, July 19, 2023

Tuesday, July 18, 2023

Training Vlog: Day 269 of Year 2 of Operation Great Reset - Build Back B...

Monday, July 17, 2023

It is not peace I have come to bring, but a sword

| Gospel |

|---|

| Matthew 10:34-11:1 © |

It is not peace I have come to bring, but a sword

Sunday, July 16, 2023

Accounting: The Language of Business - Vol. 2 (Intermediate: Part 87)

Andre Tippett was an impact player who consistently played at a level that set him apart. Accounting for him limited what an offense could do. He made quarterbacks nervous.and rightly so.

Statements of Financial Position and Cash Flows and the Annual Report (Part X)

by

Charles Lamson

DuPont Analysis

|

Saturday, July 15, 2023

Training Vlog? Day 267 of Year 2 of Operation Great Reset - Build Back B...

Friday, July 14, 2023

Accounting: The Language of Business - Vol. 2 (Intermediate: Part 86)

You'll see all other mortal sinners, the ones who flout the honor owed to gods or guests, or loving parents--you'll see them get the justice they deserve. For Hades holds men mightily to a strict accounting down below the earth; he sees all things, inscribes them within the book of his remembering.

Statements of Financial Position and Cash Flows and the Annual Report (Part W)

by

Charles Lamson

-

That's what hip-hop is: It's sociology and English put to a beat, you know. Talib Kweli Inequalities of Social Class (...

-

I'm double majoring in social studies - which is sociology, anthropology, economics, and philosophy - and African-American studies. Yara...

%20(1)%20(3)%20(1)%20(1).jpg)

%20(1)%20(3)%20(2)%20(1)%20(1).jpg)

%20(1)%20(3)%20(3)%20(1)%20(1).jpg)

%20(1)%20(1).jpg)

%20(1)%20(2).jpg)

%20(1)%20(1).jpg)

%20(1)%20(2).jpg)