Simple Interest

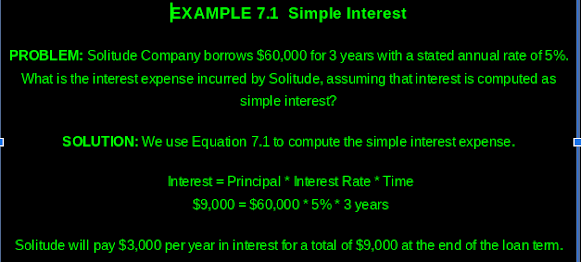

The term simple interest means that interest is computed on only the principal (the initial amount) but is not computed on any interest earned and left on deposit. The simple interest is the initial investment multiplied by the stated interest rate for a single period and the amount of time (in terms of the number of periods) the investment is held.

Simple Interest = Principal * Interest Rate * Time ( 7.1)

Compound Interest

Interest computed on both the principal and the interest left on deposit is referred to as compound interest. Any interest earned is then immediately included in the computation of the next period's interest. The compounding period can be over any time. Such as a quarter or a day.

Exhibit 7.2 provides a graphical depiction of compound interest. assume you invest $100 today for 10 years at an annual interest rate of 10%. Today (Year 0) you have $100. After the first year, you have the original $100 plus an additional $10 ($100 * 10%) of interest. So, you now leave $110 on deposit.

During the second year, that $110 also earns 10% interest or $11 ($110 * 10%). At the end of the second year, your deposit is valued at $121 ($100 + $10 plus $11). This pattern continues until the 10th year, when you have a total of $259, which consists of your original deposit or principal of $100 plus $100 of interest earned on the principal ($100 * 10% * 10 years) and $59 of interest earned on the interest left on deposit. If the interest earned only simple interest, your total value at the end of the 10th year would be $200. That is, interest would be earned only on the principal ($100 = $100 * 10% * 10 years), not on the interest left on deposit. Therefore, compounding increases your return by $59 and increases your effective interest rate.

An illustration of compound interest with annual compounding is presented in Example 7.2.

EXAMPLE 7.2 Compound Interest with Annual Compounding

PROBLEM: Solitude Company borrowed $60,000 for 3 years at a 5% interest rate with interest compounded annually. Solitude will repay the entire amount (principal plus interest) at the end of the 3-year period. Thus, it is not paying any interest until the end of the three years. How much interest will it pay? Compare this amount of Interest to the amount computed in Example 7.1 using the simple interest computation.

SOLUTION: We begin by computing the interest incurred in the first year, which is $3,000 ($60,000 * 5%). We then add this amount to the principal to compute the next period's interest of $3,150 ($63,000 * 5%). We add this amount to the principal plus interest balance at the beginning of the period to get a principal plus interest balance of $66,150 at the end of the second period. Interest in the third period is then $3,308 ($66,150 * 5%), resulting in a principal plus interest balance at the end of 3 years of $69,458.

Assuming annual compounding, the total interest is equal to $9,458 ($3,000 + $3,150 + $3,308). This total interest is $458 higher than the $9,000 simple interest incurred over the same 3-year period in Example 7.1.

As Example 7.2 shows, if interest is compounded, the total amount of interest earned or paid is higher than if simple interest is used. Likewise, the more frequently the interest is compounded, the more interest is earned. If, for example, interest is compounded monthly, then the computed interest is higher than if interest is compounded annually.

*GORDON, RAEDY, SANNELLA, 2019, INTERMEDIATE ACCOUNTING, 2ND ED., PP. 317-318*

|

No comments:

Post a Comment