To narrow your choices, age and size are useful indicators. Unless a good reason exists to do otherwise, you should probably limit the companies you consider to those that have been doing business for 25 years or more and that have annual premium value in excess of $50 million. Although these criteria will root out a lot of smaller firms, there will be plenty of companies left from which to choose. You may also find that one company is preferable for your term protection and another for your whole life needs.

Factors to consider before making the final choice include the firm's reputation, financial history, commissions and other fees, and the specifics of their policy provisions. If you are choosing a company for a cash value life insurance policy, the company's investment performance and dividend history is also an important consideration and dividend history is also an important consideration.

How do you find all of this information? Luckily, private rating agencies have done much of the work for you. These agencies use publicly available financial data from insurance companies to analyze their debt structure, pricing practices, and management strategies in an effort to assess their financial stability. The purpose is to evaluate the insurance company's ability to pay future claims made by policyholders, known as claims paying ability. In most cases, insurance firms pay ratings agencies a fee for this rating service. The ratings agencies then give each insurance firm a "grade" based on their analysis of the firm's financial data.

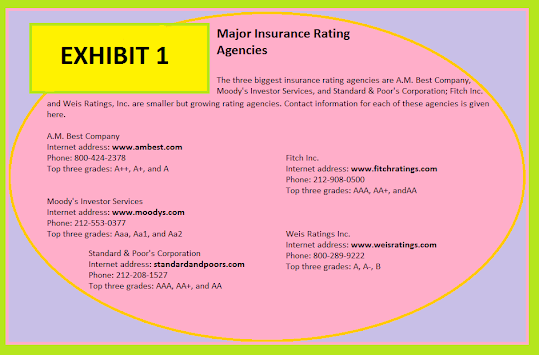

The three biggest rating agencies include A.M. Best Company, Moody's Investor Service, and Standard & Poor's Corporation (S&P). Two smaller, but growing, rating agencies are Fitch Inc. and Weis Ratings, Inc. Weiss does not charge a fee to the insurance firms it examines. Exhibit 1 provides detailed contact information for each of the major rating agencies, including their Internet addresses. Basic rating information is usually free of charge at these sites. You can also usually find these ratings on the insurance company's Web site, or you can ask your agent how the company is rated by Best's, Moody's, and S&P.

Click to enlarge.

Each rating agency uses its own grading system. When looking at these ratings, however, keep several things in mind. With the exception of Moody's and Weiss, the ratings agencies will not publish a firm's rating if the insurer requests that it be withheld. Obviously, an insurance firm receiving a low rating is more likely to suppress publication, something that should be viewed as a clear signal that it is an insurance company to avoid. Also, remember that a high rating does not insure lasting financial stability. Even highly rated insurance firms can quickly encounter financial difficulties. In fact, in a recent report A.M. Best noted that fewer life insurers are receiving top ratings. It is a good idea, therefore, to check the ratings of your insurance carrier periodically even after you have purchased a policy.

Most experts agree that it is wise to purchase life insurance only from insurance companies that are assigned ratings by at least two of the major rating agencies and are consistently rated in the top two or three categories (say, Aaa, Aa1, or Aa2 by Moody's) by each of the major agencies from which they received ratings.

*SOURCE: PERSONAL FINANCIAL PLANNING, 10TH ED., 2005, LAWRENCE J. GITMAN, MICHAEL D. JOEHNK, PGS. 345-346*

end

|

No comments:

Post a Comment