The Credit Bureau

by

Charles Lamson

Basically, a credit bureau is a type of reporting agency that gathers and sells information about individual borrowers. If, as is often the case, the lender does not know you personally, it must rely on a cost effective way of verifying your employment and credit history. It would be far too expensive and time-consuming for individual creditors to confirm your credit application on their own, so they turn to credit bureaus that maintain fairly detailed credit files about you.

|

Contrary to popular opinion, your credit file does not contain everything anyone would ever want to know about you---there is nothing on your lifestyle, friends, habits, or religious or political affiliations. Instead most of the information is pretty dull stuff, and covers such things as:

While one late MasterCard payment probably will not make much of a difference on an otherwise clean credit file, a definite pattern of delinquencies (consistently being 30 to 60 days late with your payments) or a personal bankruptcy certainly will. Unfortunately, poor credit traits will stick with you for a long time, because delinquencies will remain on your credit file for as long as 7 years, and bankruptcies for ten years.

Local credit bureaus (there are about a thousand of them) are established and mutually owned by local merchants and banks. They collect and store credit information on people living within the community and make it available, for a fee to members who request it. Local bureaus are linked together nationally through one of the "big three" national bureaus---Trans-Union, Equifax Credit Information Services, and Experian---each of which provides the mechanism for obtaining credit information from almost any place in the United States. It is important to understand that credit bureaus merely collect and provide credit information. They do not analyze it, they do not rate it (or at least they're not supposed to), and they certainly do not make the final credit decision.

Credit bureaus have been heavily criticized because of the large numbers of reporting errors and their poor record in correcting these errors on a timely and efficient basis. And consumers have been frustrated by the time-consuming process and credit bureaus' apparent "care less" attitude about their mistakes---as far as they are concerned, you are guilty until you are proven innocent. Fortunately, things have changed in recent years as the major credit bureaus have taken a more consumer oriented approach, greatly improving their customer service and dispute resolution procedures and making reports easier to read. Many of these changes were formalized by a 1995 amendment to the Fair Credit Reporting Act that established industry guidelines for credit reporting procedures. According to this legislation, credit bureaus must provide you with low-cost copies of your own credit report, and they must have toll-free phone numbers. Disputes must be resolved in 30 days and take the consumer's documentation into account, not just the creditor's.

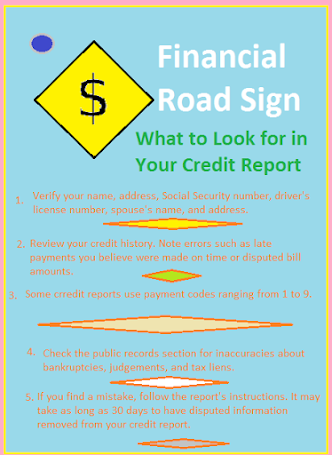

Even with these changes, though, credit bureaus still make mistakes. Unfortunately, when they do, it can mean big problems for you, because a credit report can effect whether or not you get credit. Millions of Americans have learned the hard way that their credit records are riddled with errors. You should ensure that your credit report accurately reflects your credit history. The best way to do this is to obtain a copy or your own credit report, and then go through it very carefully. If you do find a mistake, let the credit bureau know immediately---and by all means, put it in writing; then request a copy of the corrected file to make sure that the mistake has been eliminated. Most consumer advisors recommend that you review your credit files annually.

You are entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228.

*SOURCE: PERSONAL FINANCIAL PLANNING, 10TH ED., 2005, LAWRENCE J. GITMAN, PGS. 251-253*

end

|

No comments:

Post a Comment