The Balance Sheet: How Much Are You Worth Today?

by

Charles Lamson

If you want to track your progress toward your financial goals, you need a starting point that shows how much you are worth today. Preparing a personal balance sheet, or statement of financial position, will give them this important information. This financial statement represents a person's (or family's) financial condition at a certain point in time. Think of a balance sheet as a snapshot taken of a person's financial position on one day out of the year.

|

A balance sheet has three parts that, taken together, represent a summary of your financial picture:

The accounting relationship among these three categories is called the balance sheet equation, and is expressed as follows:

Total assets = Total liabilities + Net worth

or

Net worth = Total assets - Total liabilities

Let's now look at the components of each section of the balance sheet.

Assets: The Things You Own Assets are the items you own. An item is classified as an asset regardless of whether it was purchased for cash or financed with debt. In other words, even if you have not fully paid for an asset, you should list it on the balance sheet. An item that is leased, in contrast, is not shown as an asset, because someone else actually owns it.

A useful way to group assets is on the basis of their underlying characteristics and uses. This results in four broad categories: liquid assets, investments, real property, and personal property.

About 40 percent of the average household's assets consists of financial assets (liquid assets and investments); nearly half is real property (including housing); and the rest is other nonfinancial assets. The first section of Worksheet 1 lists some of the typical assets you would find on a personal balance sheet.  Sample personal balance sheet. All assets, regardless of category, are recorded on the balance sheet at their current fair market value, which may differ considerably from their original purchase price. Fair market value is either the actual value of the asset (such as money in a checking account) or the price that the asset can reasonably be expected to sell for in the open market (such as a used car or a home). Those of you who have taken accounting will notice a difference between the way assets are recorded on a personal balance sheet and a business balance sheet. Under Generally Accepted Accounting Principals (GAAP), the accounting profession's guiding rules, assets appear on a company's balance sheet at cost, not fair market value. One reason for the disparity is that in business, an asset's value is often subject to debate and uncertainty. The user of the statements may be an investor, and accountants like to be conservative in their measurement. For purposes of personal financial planning, the user and the preparer of the statement are one and the same. Besides, most personal assets have market values that can be easily estimated. Liabilities: The Money You Owe Liabilities represent an individual's or family's debts. They could result from department store charges, bank credit card charges, installment loans, or mortgages on housing and other real estate. A given liability, regardless of its source, is something that you owe and must repay in the future. Liabilities are generally classified according to maturity:

You must show all types of loans on your balance sheet. Although most loans will fall into the category of long-term liabilities, any loans that come due within a year should be shown as current liabilities. Examples of such short-term loans include a 6-month, single-payment bank loan and a 9-month consumer installment loan for a refrigerator.

Regardless of the type of loan, only the latest outstanding loan balance should be shown as a liability on the balance sheet, because at any given point in time it is the balance still due---not the initial loan balance---that matters. Another important and closely related point is that only the principal portion of a loan or mortgage should be listed as a liability on the balance sheet. In other words, you should not include the interest portion of your payments as part of your balance sheet debt. The principal actually defines the amount of debt you owe at a given point in time and does not include any future interest payments.

Lenders evaluate a prospective borrower's liabilities carefully. Very high levels of debt and overdue debts are both viewed with a great deal of disfavor. On Worksheet 1 above, you will find the most common categories of liabilities.

Net Worth: A Measure of Your Financial Worth

Now that you have listed what you own and what you owe, you can calculate your net worth, the amount of actual wealth or equity that an individual or family has in owned assets. It represents the amount you would have left after selling all your owned assets at their estimated fair market values and paying off all your liabilities (assuming there are no transaction costs). As noted earlier, every balance sheet must "balance" so that total assets equal total liabilities plus net worth. Rearranging this equation, we see that net worth equals total assets minus total liabilities. Once you establish the fair market value of assets and the level of liabilities, you can easily calculate net worth by subtracting total liabilities from total assets. If net worth is less than zero, the family is technically insolvent. Although this form of insolvency does not mean that the family will end up in bankruptcy proceedings, it does reflect the absence of adequate financial planning.

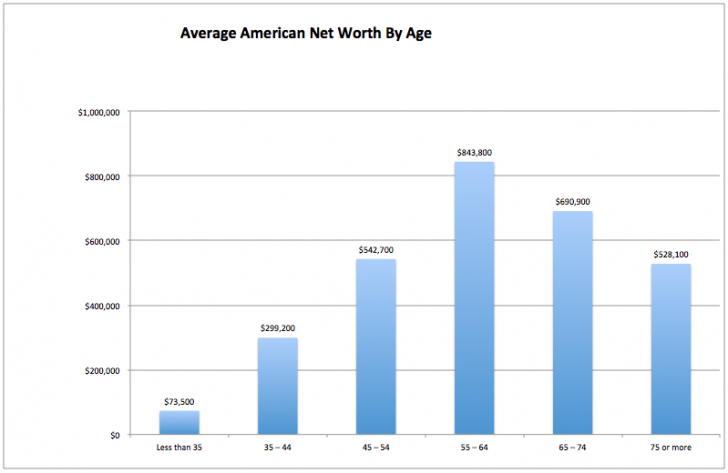

Exhibit 1

Source: The Average Net Worth By Age For The Upper Middle Class https://www.financialsamurai.com/the-average-net-worth-by-age-for-the-upper-middle-class/.

Net worth typically increases over the life cycle of an individual or family, as Exhibit 1 illustrates. For example, the balance sheet of a college student will probably be fairly simple. Assets would include modest liquid assets (cash, checking, and savings accounts) and personal property, which may include a car. Liabilities might include utility bills, perhaps some open account credit obligations, and automobile and education loans. At this point in life, net worth would typically be very low, because assets are small in comparison with liabilities. A 29-year-old, single school teacher would have more liquid assets and personal property, may have started an investment program, and may have purchased a condominium. Net worth would be rising but may still be low due to the increased liabilities associated with real and personal property purchases. The high net worth of a two-career couple in their late thirties with children would reflect a greater proportion of assets relative to liabilities as they save for college expenses and retirement.

In the long-term financial planning process, the level of net worth is important. Once you have established a goal of accumulating a certain level or type of wealth, you can track progress toward that goal by monitoring net worth.

*SOURCE: PERSONAL FINANCIAL PLANNING, 10TH ED., 2005, LAWRENCE J. GITMAN, MICHAEL D. JOEHNK, PGS. 56-59*

END

|

No comments:

Post a Comment