Preparing the Income and Expense Statement

by

Charles Lamson

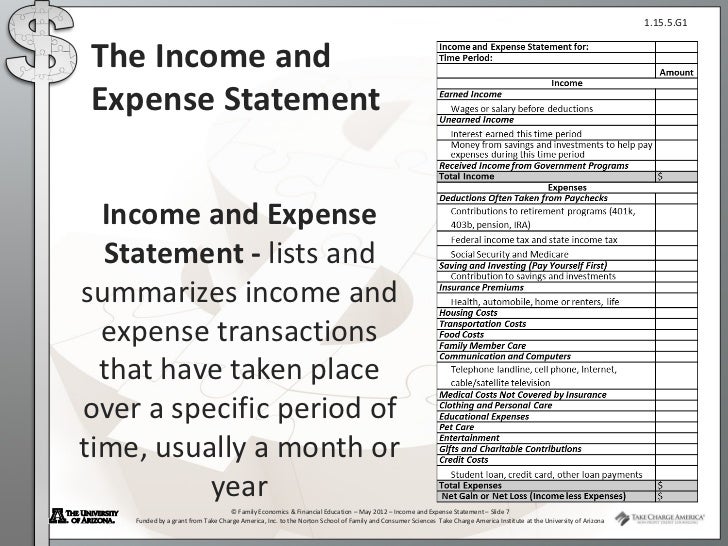

As shown in Worksheet 2 (from last post and also below), the income and expense statement is dated to define the period covered. The steps to prepare the statement are:

- Record your income for all sources for the chosen period. Use your salary check stubs to verify your gross pay for the period, and be sure to include bonuses, commission checks, and overtime pay. You will find interest earned, securities bought and sold, interest and dividends received, and other investment matters on your bank and investment account statements. Keep a running list of other income sources, such as rents and tax refunds.

- Establish meaningful expense categories. Those shown on Worksheet 2 provide a good starting point. Information on monthly house (or rent) payments, loan payments, and other fixed payments (such as insurance premiums and cable TV), is readily available from either the payment book or your checkbook (or, in the case of payroll deductions, your check stubs). (Note: Be careful with so-called adjustable rate loans, because the amount of monthly loan payments will change when the interest rate changes.)

- Subtract total expenses from total income to get the cash surplus (a positive number) or deficit (a negative number). This "bottom line" summarizes the net cash flow resulting from your financial activities during the designated period.

|

Worksheet 2

You will probably pay for most major variable expenses by check, debit card, or credit card, so it is easy to keep track of them. It is more difficult to keep tabs on all the items in a month that you pay with cash, such as parking, lunches, movies, and incidentals. Most of us do not care to write down every little expense to the penny. You might try counting the cash in your wallet at the beginning of the month, then count again after a week goes by to see how much money is missing. Try to reconstruct in your mind what you spent during the week, and write it down on your calendar to the nearest $5. If you cannot remember, then try the exercise over shorter and shorter periods until you can.

Just as you show only the amounts of cash actually received as income, record only the amounts of money you actually pay out in cash as expenses. If you borrow to acquire an item, particularly an asset, include only the actual cash payment---purchase price minus amount borrowed---as an expense, as well as payments on the loan in the period you actually make them. You show credit purchases of this type as an asset and corresponding liability on the balance sheet. Record only the cash payments on loans, not the actual amounts of the loans themselves, on the income and expense statement.

For example, assume that you purchase a new car for $15,000 in September. You make a down payment of $3,000 and finance the remaining $12,000 with a 4-year 10.5 percent installment loan. Your September 30 income statement would show a cash expenditure of $3,000 and each subsequent monthly income statement would include your monthly loan payment of $307. Your September 30 balance sheet would show the car as an asset valued at $15,000 and the loan balance as a $12,000 long-term liability. The market value of the car and the loan balance would be adjusted on future balance sheets.

Finally, when developing your list of expenses for the year, remember to include the amount of income tax and Social Security taxes withheld from your paycheck, and any other payroll deductions, such as health insurance, savings plans, retirement, and pension contributions, and professional/union dues. These deductions (from gross wages, salaries, bonuses, and commissions) represent personal expenses, even if they do not involve the direct payment of cash.

You might be shocked when you make a list of what is taken out of your paycheck. Even if you are in a fairly low federal income tax bracket, your paycheck could easily be reduced by more than 25 percent for taxes alone. Your federal tax could be withheld at 15 percent, your state income tax could be withheld at 5 percent, and your Social Security tax could be withheld at 7 percent. This does not even include health and disability insurance.

Preparing income and expense statements can involve a lot of number crunching. Fortunately, a number of good company software packages, such as Quicken and Microsoft Money, can simplify the job of preparing personal financial statements and performing other personal financial planning tasks.

*SOURCE: PERSONAL FINANCIAL PLANNING, 10TH ED., 2005, LAWRENCE J. GITMAN, MICHAEL D. JOEHNK, PGS. 65-66*

END

|

No comments:

Post a Comment