TOP STORIES

Search Results

Water released from dams on Missouri River reduced

KBIA-8 hours ago

The amount of water being released into the lower Missouri River will be temporarily reduced because of recent heavy rains in southeastern ...

Proposed Natural Gas Pipeline Would Run Under Missouri River

COMPRESSORtech2-6 hours ago

Kinder Morgan wants to build a pipeline under the Missouri River in North Dakota to connect its existing Brogger compressor station to an ...

Two bodies found in camper at Missouri River fishing access site

Great Falls Tribune-20 hours ago

The Cascade County Sheriff's Office is investigating the deaths of two people at a fishing access site on the Missouri River. Authorities were ...

Tracking Financial Progress:

Ratio Analysis

by

Charles Lamson

Each time you prepare your financial statements, you should analyze them to see how well you are doing in light of your financial goals. For example, with an income and expense statement, you can compare actual financial results with budgeted figures to make sure that your spending is under control. Likewise, comparing a set of financial plans with a balance sheet will reveal whether you are meeting your savings and investment goals, reducing your debt, or building up a retirement reserve. You can compare current performance with historical performance to find out if your financial situation is improving or getting worse.

| ||

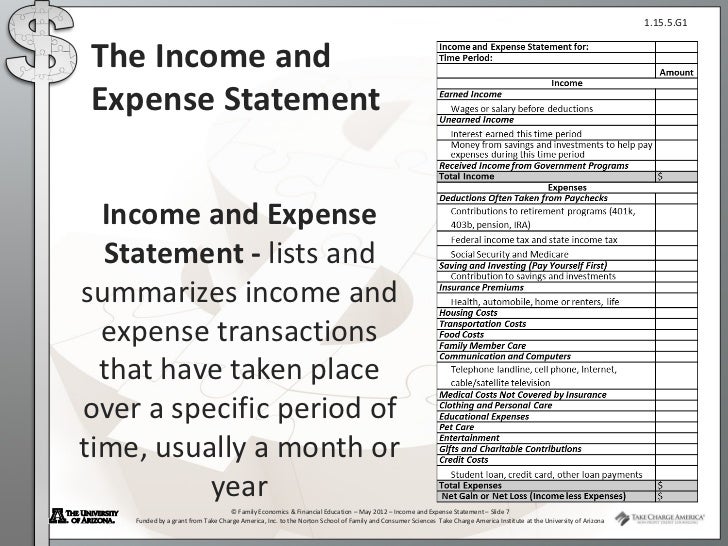

Calculating certain financial ratios can help you evaluate your financial performance over time. Moreover, if you apply for a loan, the lender probably will look at these ratios to judge your ability to carry additional debt. Four important money management ratios are the (1) solvency ratio, (2) liquidity ratio, savings ratio, (3) savings ratio, and (4) debt service ratio. The first two are associated primarily with the balance sheet (Figure 1), while the last two relate primarily to the income and expense statement (Figure 2).

Figure 1 Personal balance sheet.

Balance Sheet Ratios

When evaluating your balance sheet, you should be most concerned with your net worth at a given point in time. You are technically insolvent when your total liabilities exceed your total assets---that is when you have a negative net worth. The solvency ratio shows, as a percentage, your degree of exposure to insolvency, or how much "cushion" you have as a protection against insolvency.

Although the solvency ratio gives an indication of the potential to withstand financial problems, it does not deal directly with the ability to pay current debts. This issue is addressed with the liquidity ratio, which shows how long you could continue to pay current debts (any bills or charges that must be paid within 1 year) with existing liquid assets in the event of income loss. The amount of liquid reserves will vary with your personal circumstances and "comfort level." Another useful liquidity guideline is to have a reserve fund equal to 3 to 6 months of after-tax income available to cover living expenses. If you feel that your job is secure or you have other potential sources of income, you may be comfortable with 3 or 4 months in reserve. If you tend to be very cautious financially, you may want to build a larger fund. In troubled economic times, you may want to keep 6 months or more of income in this fund as protection should you lose your job.

When evaluating your income and expense statement (Figure 2), you should be concerned with the bottom line, which shows the cash surplus (or deficit) resulting from the period's activities. You can release it to income by calculating a savings ratio, which is done most effectively with after-tax income.

Figure 2 Income and Expense Statement.

How much to save is a personal choice. Some families would plan much higher levels, particularly if they are saving to achieve an important goal, such as buying a home. While maintaining an adequate level of savings is obviously important to personal financial planning, so is the ability to pay debts promptly. In fact, debt payments have a higher priority. The debt service ratio allows you to make sure you can comfortably meet your debt obligations. This ratio excludes current liabilities and considers only mortgage, installment, and personal loan obligations.  From a financial planning perspective, you should try to keep your debt service ratio somewhere under 35 percent or so, because that is generally viewed as a manageable level of debt---and, of course, the lower the debt service ratio, the easier it is to meet loan payments as they come due. *SOURCE: PERSONAL FINANCIAL PLANNING, 10TH ED., LAWRENCE J. GITMAN, 2005, PGS. 68-71*

END

|

No comments:

Post a Comment