The Income and Expense Statement:

What We Earn and Where It Goes

by

Charles Lamson

Where does all the money go? Preparing an income and expense statement would provide this answer. Whereas the balance sheet (from last post) describes a person's or family's financial position at a given point in time, the income and expense statement captures the various financial activities that have occurred over time---normally over the course of a year, although it technically can cover any time period (month, quarter, and so on). Think of this statement as a motion picture that not only shows actual results over time but also allows you to compare them with budgeted financial goals as well. Equally important, the statement allows you to evaluate the amount of saving and investing during the period it covers.

Worksheet 1

Sample personal balance sheet (from last post)

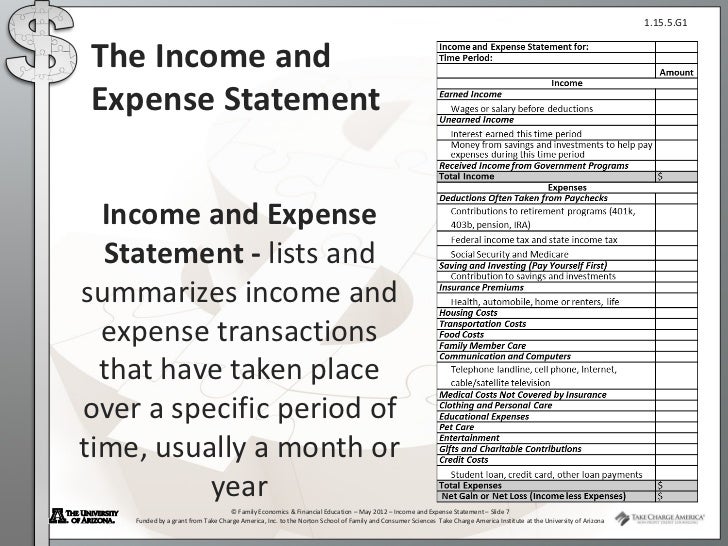

Like the balance sheet (from last post - see Worksheet 1), the income and expense statement (Worksheet 2) has three major parts: income, expenses, and cash surplus (or deficit). A cash surplus (or deficit) is merely the difference between income and expenses. The statement is prepared on a cash basis, which means that only transactions involving actual cash receipts or actual cash outlays (an amount of money that you spend on something, especially a large amount that is spent on new equipment or to start a new business activity) are recorded. The term cash is used in this case to include not only coin and currency but also checks drawn against demand deposits and certain types of savings accounts.

Worksheet 2

The income and expense statement.

Income and expense patterns change over the individual's or family's life cycle. Income and spending levels rise steadily to a peak in the 45-54 age bracket. On average, persons in this age group, whose children are typically in college or no longer at home, generally have the highest level of income. They also spend more than other age groups on entertainment, dining out, transportation, education, insurance, and charitable contributions. Families in the 35-44 age bracket have slightly lower average levels of income and expenses but very different spending patterns. Because they tend to have school-age children, they spend more on groceries, housing, clothing, and other personal needs.

Income: Cash In

Common sources of income include earnings received as wages, salaries, self-employment, bonuses, and commissions; interest and dividends received from savings and investments; and proceeds from the sale of assets, such as stocks or bonds or an auto. Other income items include pension or annuity income; rent received from leased assets; alimony and child support; scholarships, grants, and Social Security received; tax refunds; and miscellaneous types of income. Worksheet 2 (above) has general categories to record your income.

Note also that the proper figure to use is gross wages, salaries, and commissions, which constitute the amount of income you receive from your employer before taxes and other payroll deductions. The gross value is used because the taxes and payroll deductions will be itemized and deducted as expenses later in the income and expense statement. Therefore, you should not use take-home pay, because it will understate your income by the amount of these deductions.

Expenses: Cash Out

Expenses represent money used for outlays. Worksheet 2 categorizes them by the types of benefits they provide: (1) living expenses (such as housing, utilities, food, transportation, medical, clothing and insurance), (2) tax payments, (3) asset purchases (such as autos, stereos, furniture, appliances, and loan payments on them), and (4) debt payments (on mortgages, installment loans, credit cards, and so on). Some are fixed expenses, which are usually contractual, predetermined, and involve equal payments each period (typically each moth). Examples include mortgage and installment loan payments, insurance premiums, professional or union dues, club dues, monthly savings, or investment programs, and cable television fees. Others (such as food, clothing, utilities, entertainment, and medical expenses) are variable expenses, because their amounts change from one time period to the next.

Your expenses will vary according to your age, lifestyle, and where you live. For example, it costs considerably more to buy a home in San Diego than in Indianapolis. If you live in the suberbs, your continuing expenses will be higher than those of city dwellers.

Cash Surplus (Or Deficit)

The third component of the income and expense statement shows the net result of the period's financial activities. Subtracting total expenses from total income gives you the cash surplus (or deficit) for the period. At a glance, you can see how you did financially over the period. A positive figure indicates that expenses were less than income, resulting in a cash surplus. A value of zero indicates that expenses were exactly equal to income for the period, while a negative value means that your expenses exceeded income and you have a cash deficit.

You can use a cash surplus for savings or investment purposes, to acquire assets, or to reduce debt. Adding to savings or investments should increase your future income and net worth, and making payments on debt affects cash flow favorably by reducing future expenses. In contrast, when a cash deficit occurs, you must cover the shortfall from your savings or investments, reduce assets, or borrow. All of these strategies will reduce net worth and have undesirable effects on your financial future.

One final point: a cash surplus does not necessarily mean that funds are simply lying around waiting to be used. Because the income and expense statement reflects what has actually occurred, the disposition of the surplus (or deficit) is reflected in the asset, liability, and net worth accounts on the balance sheet. For example, if you used the surplus to make investments, this would increase the appropriate asset account. If it were used to pay off a loan, the payment would reduce that liability account. Of course, if you used the surplus to increase cash balances, you would have the funds to use. In each case, your net worth increases. Whereas surpluses add to net worth, deficits reduce it, whether the shortfall is financed by reducing an asset (for example, drawing down a savings account) or by borrowing.

*SOURCE: PERSONAL FINANCIAL PLANNING, 10TH ED., 2005, LAWRENCE J. GITMAN, MICHAEL D. JOEHNK, PGS. 61-65*

END

|

No comments:

Post a Comment